Administrator pinned this post

3 months ago

Get $10 for Every 100 Followers!

Don't miss out on this limited-time offer! For every 100 followers you gain, you'll receive $10.

Hurry, the campaign ends without prior notice! Be sure to take advantage before it’s too late.

For more details, check the banner.

Don't miss out on this limited-time offer! For every 100 followers you gain, you'll receive $10.

Hurry, the campaign ends without prior notice! Be sure to take advantage before it’s too late.

For more details, check the banner.

18 days ago

Ethereum remains the top platform for developing decentralized apps.

Polkadot provides developers more flexibility with its parachains.

The blue chip leader might have more upside potential than the tiny underdog.

10 stocks we like better than Ethereum ›

Ethereum (CRYPTO: ETH) and Polkadot (CRYPTO: DOT) generally attract different types of cryptocurrency investors. Ether, the native token of the Ethereum blockchain, is the world's second-most-valuable cryptocurrency after Bitcoin (CRYPTO: BTC). It's often considered a "blue chip" token, more stable than smaller altcoins or meme coins. A $1

Polkadot provides developers more flexibility with its parachains.

The blue chip leader might have more upside potential than the tiny underdog.

10 stocks we like better than Ethereum ›

Ethereum (CRYPTO: ETH) and Polkadot (CRYPTO: DOT) generally attract different types of cryptocurrency investors. Ether, the native token of the Ethereum blockchain, is the world's second-most-valuable cryptocurrency after Bitcoin (CRYPTO: BTC). It's often considered a "blue chip" token, more stable than smaller altcoins or meme coins. A $1

19 days ago

The recent crypto crash continued on Monday as Bitcoin and most altcoins remained in the red amid rising geopolitical jitters. Bitcoin dropped to $87,380, while Ethereum, Dogecoin, Solana, and XRP fell by over 3% in the last 24 hours.

One key reason behind the ongoing crypto market crash is that liquidations continued rising. Data compiled by CoinGlass shows that liquidations soared by 770% in the last 24 hours to $678 million.

Ethereum liquidations jumped to over $218 million, while Bitcoin liquidations jumped to $195 million. Solana liquidations jumped to $63 million. The other top liquida

One key reason behind the ongoing crypto market crash is that liquidations continued rising. Data compiled by CoinGlass shows that liquidations soared by 770% in the last 24 hours to $678 million.

Ethereum liquidations jumped to over $218 million, while Bitcoin liquidations jumped to $195 million. Solana liquidations jumped to $63 million. The other top liquida

1 month ago

Crypto Investment Themes for 2026: Bitcoin, Stablecoins and RWAs

After a volatile 2025, investors are rethinking crypto cycles. Here are three investment themes that will shape the market’s next phase in 2026.

COINTELEGRAPH IN YOUR SOCIAL FEED

2025 didn’t unfold the way many cryptocurrency investors expected.

Although Bitcoin

BTC

$88,813

peaked almost precisely in line with its historical four-year cycle, the long-anticipated blow-off top never materialized. Notably, Bitcoin’s gains failed to cascade into the broader market, leaving hopes for a full-fledged altcoin season largely unfu

After a volatile 2025, investors are rethinking crypto cycles. Here are three investment themes that will shape the market’s next phase in 2026.

COINTELEGRAPH IN YOUR SOCIAL FEED

2025 didn’t unfold the way many cryptocurrency investors expected.

Although Bitcoin

BTC

$88,813

peaked almost precisely in line with its historical four-year cycle, the long-anticipated blow-off top never materialized. Notably, Bitcoin’s gains failed to cascade into the broader market, leaving hopes for a full-fledged altcoin season largely unfu

2 months ago

Bitcoin’s price is hovering near $88,898, up 1.43% in the past 24 hours, with a market cap of $1.77 trillion. But behind the price action, something bigger is brewing: a record surge in institutional interest. In 2025, mentions of blockchain in SEC filings skyrocketed, hitting around 8,000 by August and staying elevated through November.

Bitcoin dominated these filings, thanks to the rollout of spot Bitcoin ETFs and amendments from major ******* et managers expanding their crypto offerings.

Unlike past cycles where ICOs and altcoins grabbed headlines, this time the focus is squarely on Bitco

Bitcoin dominated these filings, thanks to the rollout of spot Bitcoin ETFs and amendments from major ******* et managers expanding their crypto offerings.

Unlike past cycles where ICOs and altcoins grabbed headlines, this time the focus is squarely on Bitco

2 months ago

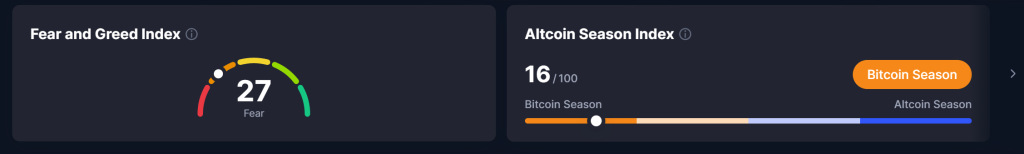

Bitcoin is hovering around $89,160 right now, having gained 1.5% in the last 24 hours. Daily trading volume is looking pretty strong at $24.3 billion and the world’s biggest cryptocurrency is still sitting pretty at top spot in market capitalisation, valued at roughly $1.78 trillion. There’s 19.97 million Bitcoin in circulation out of a total supply of 21 million.

Despite the bounce, overall market mood is still pretty cautious. The Crypto Fear and Greed Index is stuck at 27, firmly in ‘fear’ territory, and the Altcoin Season Index is down to 16, which means Bitcoin Season is well and truly i

Despite the bounce, overall market mood is still pretty cautious. The Crypto Fear and Greed Index is stuck at 27, firmly in ‘fear’ territory, and the Altcoin Season Index is down to 16, which means Bitcoin Season is well and truly i

2 months ago

2025 has been a largely strong year for the cryptocurrency market.

Bitcoin climbed to a new all-time high of $126,000 during the year, alongside the launch of several new altcoin-focused exchange-traded funds and the establishment of a Bitcoin Strategic Reserve in the United States.

The period was also marked by continued accumulation of Bitcoin by corporate treasury holders such as Strategy, as well as a series of broader macroeconomic developments that influenced digital ******* et markets.

https://invezz.com/news/20...

Bitcoin climbed to a new all-time high of $126,000 during the year, alongside the launch of several new altcoin-focused exchange-traded funds and the establishment of a Bitcoin Strategic Reserve in the United States.

The period was also marked by continued accumulation of Bitcoin by corporate treasury holders such as Strategy, as well as a series of broader macroeconomic developments that influenced digital ******* et markets.

https://invezz.com/news/20...

2 months ago

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Bitcoin (CRYPTO: BTC) and Ethereum (CRYPTO: ETH) saw $1.4 billion in liquidations over the past week as retail capitulates on altcoins and rotates back into majors.

What Happened: Bitcoin slipped below $85,000 mid-week before grinding back to $90,000 by the end of last week, though it has failed to follow through this week.

Ethereum dropped below $3,000 as liquidations hit $600 million Monday, then another $400 million on Wednesday and Thursday, respectively

The damage was severe but short-

Bitcoin (CRYPTO: BTC) and Ethereum (CRYPTO: ETH) saw $1.4 billion in liquidations over the past week as retail capitulates on altcoins and rotates back into majors.

What Happened: Bitcoin slipped below $85,000 mid-week before grinding back to $90,000 by the end of last week, though it has failed to follow through this week.

Ethereum dropped below $3,000 as liquidations hit $600 million Monday, then another $400 million on Wednesday and Thursday, respectively

The damage was severe but short-

2 months ago

Bitcoin dominance continues its relentless climb as markets consolidate into year-end, leaving altcoins trapped under heavy supply pressure and an unforgiving token unlock schedule.

Wintermute’s latest market update confirms what many traders feared. Retail investors are rotating out of altcoins and back into major **** ets, signaling the end of the anticipated altcoin rally that typically follows Bitcoin’s strong performance.

The broader crypto market extended losses over the past 24 hours, with Bitcoin slipping 1.12% below $87,000 and Ethereum dropping 1.5% near $3,000.

Several altcoins s

Wintermute’s latest market update confirms what many traders feared. Retail investors are rotating out of altcoins and back into major **** ets, signaling the end of the anticipated altcoin rally that typically follows Bitcoin’s strong performance.

The broader crypto market extended losses over the past 24 hours, with Bitcoin slipping 1.12% below $87,000 and Ethereum dropping 1.5% near $3,000.

Several altcoins s

2 months ago

Bitcoin is trading around $87,450, down about 1.2% over the past 24 hours, with daily turnover near $42.5 bn. Despite the pullback, BTC remains the largest crypto ******* et, carrying a market value of roughly $1.75 tn and a circulating supply just under 20 mn coins, close to its hard cap of 21 mn.

Broader market sentiment has softened. The Crypto Fear and Greed Index sits at 29, firmly in “fear” territory, while the Altcoin Season Index is at 17, signaling a clear Bitcoin-dominant phase. Total crypto market capitalization hovers near $2.96 tn, suggesting capital is consolidating rather than

Broader market sentiment has softened. The Crypto Fear and Greed Index sits at 29, firmly in “fear” territory, while the Altcoin Season Index is at 17, signaling a clear Bitcoin-dominant phase. Total crypto market capitalization hovers near $2.96 tn, suggesting capital is consolidating rather than

2 months ago

Bitcoin is trading near $87,550, down roughly 2.6% over the past 24 hours, as short-term sentiment cools across crypto markets. Despite the pullback, the broader structure suggests consolidation rather than collapse. Bitcoin remains the largest digital ***** et by market value, with a capitalization of $1.74 tn, while daily trading volume holds above $42 bn, signaling continued institutional and retail participation.

Market-wide indicators reinforce the cautious tone. The Crypto Fear and Greed Index sits at 29, firmly in “fear” territory, while the Altcoin Season Index reads just 17, undersco

Market-wide indicators reinforce the cautious tone. The Crypto Fear and Greed Index sits at 29, firmly in “fear” territory, while the Altcoin Season Index reads just 17, undersco

2 months ago

Ether vs. Bitcoin teases 170% gains as ETH price breaks 5-month downtrend

Ether price action staged a repeat of its 2021 bull market moves against Bitcoin, leading to predictions of fresh long-term highs against BTC.

Ether

ETH

$3,140

is teasing 170% gains in under two months as history repeats itself against Bitcoin

BTC

$91,395

.

Key points:

Ether has the potential to rematch long-term highs above 0.09 in Bitcoin terms.

Bull market history continues to play out for the largest altcoin, with $3,700 the next target.

https://cointelegraph.com/...

Ether price action staged a repeat of its 2021 bull market moves against Bitcoin, leading to predictions of fresh long-term highs against BTC.

Ether

ETH

$3,140

is teasing 170% gains in under two months as history repeats itself against Bitcoin

BTC

$91,395

.

Key points:

Ether has the potential to rematch long-term highs above 0.09 in Bitcoin terms.

Bull market history continues to play out for the largest altcoin, with $3,700 the next target.

https://cointelegraph.com/...

2 months ago

Bitcoin (BTC) reversed its overnight climb to $94,000, dipping back to $92,000 during U.S. hours Thursday, continuing choppy rangebound action after the wild moves first lower, than higher earlier int he week.

Ethereum’s ether (ETH) held up relatively well, down only 0.7% on the day and changing hands above $3,100 in the afternoon hours. Among altcoins, XRP (XRP), Hedera (HBAR), Bitcoin Cash (BCH) and privacy-oriented Zcash (ZEC) led the downside with 4%–5% declines, while the broad-market CoinDesk 20 Index was 2% lower.

Despite the pullback, BTC continues to hold well above the support leve

Ethereum’s ether (ETH) held up relatively well, down only 0.7% on the day and changing hands above $3,100 in the afternoon hours. Among altcoins, XRP (XRP), Hedera (HBAR), Bitcoin Cash (BCH) and privacy-oriented Zcash (ZEC) led the downside with 4%–5% declines, while the broad-market CoinDesk 20 Index was 2% lower.

Despite the pullback, BTC continues to hold well above the support leve

2 months ago

The total crypto market cap (TOTAL) witnessed a sharp drop today as over $162 billion was wiped out in the last 24 hours. Bitcoin (BTC) fell below $86,000 in the process, with altcoins following suit, led by Zcash (ZEC), falling by 20% today.

In the news today:-

Global capital is pouring into US markets at record levels, with foreign investors heavily buying equities and Treasury demand shifting structurally. Meanwhile, US consumer debt has hit an all-time high, signaling a major shift in global risk appetite that could impact both crypto and equity markets.

Japan’s 2-year bond yield hit 1%

In the news today:-

Global capital is pouring into US markets at record levels, with foreign investors heavily buying equities and Treasury demand shifting structurally. Meanwhile, US consumer debt has hit an all-time high, signaling a major shift in global risk appetite that could impact both crypto and equity markets.

Japan’s 2-year bond yield hit 1%

3 months ago

Bitcoin and Ethereum are mostly flat ahead of the Thanksgiving holiday on Thursday.

Bitcoin and Ethereum are down nearly 1% over 24 hours, while XRP is down 3.1%, undoing Monday’s ETF-driven gains, according to CoinGecko data. The performance of Solana, BNB, Dogecoin, and other top altcoins hovers between -1% and 1%.

While the broader traditional finance sector remains closed on Thursday's Thanksgiving holiday, crypto markets will remain open. However, due to the holiday, liquidity and volume are often drained from the market, which could trigger volatile moves.

“I wouldn’t read today’s mar

Bitcoin and Ethereum are down nearly 1% over 24 hours, while XRP is down 3.1%, undoing Monday’s ETF-driven gains, according to CoinGecko data. The performance of Solana, BNB, Dogecoin, and other top altcoins hovers between -1% and 1%.

While the broader traditional finance sector remains closed on Thursday's Thanksgiving holiday, crypto markets will remain open. However, due to the holiday, liquidity and volume are often drained from the market, which could trigger volatile moves.

“I wouldn’t read today’s mar

3 months ago

Zcash grew by more than double in the last 30 days.

Bitcoin lost value in the same period.

It will take a lot more than a month of poor performance to dislodge crypto's biggest ******* et.

10 stocks we like better than Bitcoin ›

Bitcoin (CRYPTO: BTC) investors watched a long parade of supposed "better Bitcoins" try to dethrone the original. All have faded, but the idea that a more feature-rich version of Bitcoin could take the crown keeps resurfacing.

https://finance.yahoo.com/...

Bitcoin lost value in the same period.

It will take a lot more than a month of poor performance to dislodge crypto's biggest ******* et.

10 stocks we like better than Bitcoin ›

Bitcoin (CRYPTO: BTC) investors watched a long parade of supposed "better Bitcoins" try to dethrone the original. All have faded, but the idea that a more feature-rich version of Bitcoin could take the crown keeps resurfacing.

https://finance.yahoo.com/...

3 months ago

Crypto market braces for Yen carry trades unwind as **** an's long-term bond yield hits new high.

Bitcoin, Ethereum, XRP and other altcoins pare gains ahead of Nvidia earnings, FOMC minutes, NFP jobs data.

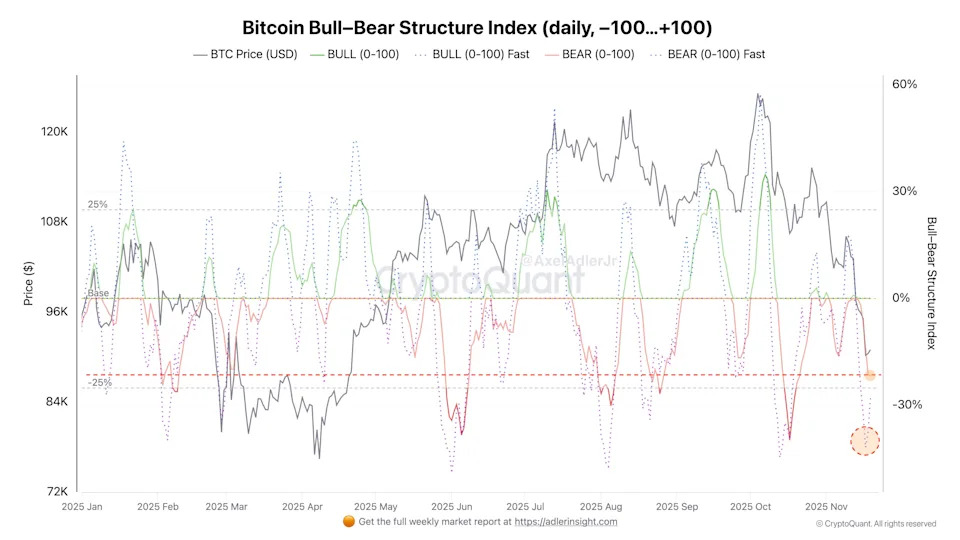

Bull-Bear Structure Index signals continued dominance of bearish factors.

Bitcoin, Ethereum, XRP and other altcoins pare gains as the crypto market braces for another potential selloff. New macro jitters are unlocking ahead of key events such as Nvidia earnings, FOMC minutes release, and Nonfarm payroll jobs data this week.

Japan’s long-term government bond yields surge to record highs f

Bitcoin, Ethereum, XRP and other altcoins pare gains ahead of Nvidia earnings, FOMC minutes, NFP jobs data.

Bull-Bear Structure Index signals continued dominance of bearish factors.

Bitcoin, Ethereum, XRP and other altcoins pare gains as the crypto market braces for another potential selloff. New macro jitters are unlocking ahead of key events such as Nvidia earnings, FOMC minutes release, and Nonfarm payroll jobs data this week.

Japan’s long-term government bond yields surge to record highs f

3 months ago

Bitcoin plunged to a six-month low of $91,545 on Tuesday morning in Asia, breaching key support. Ethereum also slipped below $3,000, highlighting widespread market weakness.

The crypto downturn aligned with traditional markets, which endured their worst session in a month.

Bitcoin's 3.21% daily loss on November 17 brought its value down by 27% from its October all-time high. Ethereum posted a deeper 4.22% fall to $2,978. Major altcoins also saw sharp weekly declines. Solana tumbled 22.51%, XRP slid 16.73%, and Cardano fell 22.12% over the seven-day period.

Losses extended beyond crypto. The

The crypto downturn aligned with traditional markets, which endured their worst session in a month.

Bitcoin's 3.21% daily loss on November 17 brought its value down by 27% from its October all-time high. Ethereum posted a deeper 4.22% fall to $2,978. Major altcoins also saw sharp weekly declines. Solana tumbled 22.51%, XRP slid 16.73%, and Cardano fell 22.12% over the seven-day period.

Losses extended beyond crypto. The

Sponsored by

Blue Mong

3 months ago