1 day ago

These are nervous times for Bitcoin (CRYPTO: BTC) investors. The world's most popular cryptocurrency is down a staggering 45% from its all-time high of $126,000 just a few months ago. It's now trading for just $70,000, and some think it might fall all the way to $50,000.

It's a stunning, epic collapse. But it's also nothing new for longtime Bitcoin investors. After every collapse, Bitcoin goes on to set a new all-time high. And that's what I think will happen this time as well. With that in mind, here are two ways to put $500 to work right now.

Will AI create the world's first trillionaire?

It's a stunning, epic collapse. But it's also nothing new for longtime Bitcoin investors. After every collapse, Bitcoin goes on to set a new all-time high. And that's what I think will happen this time as well. With that in mind, here are two ways to put $500 to work right now.

Will AI create the world's first trillionaire?

4 days ago

4 days ago

Sell-side pressure for Bitcoin, which last week brought the world’s largest crypto to its lowest point since President Donald Trump was elected for a second term, has begun to abate.

Analysts point to increasing demand from large buyers, the balance of aggressive buying and selling, and the percentage of supply in profit as evidence that the drawdown could be running out of steam.

“From the perspective of price action and on-chain distribution, the pace of the decline is indeed decelerating,” Tim Sun, senior researcher at HashKey Group, told Decrypt. “However, we have yet to see a signal for

Analysts point to increasing demand from large buyers, the balance of aggressive buying and selling, and the percentage of supply in profit as evidence that the drawdown could be running out of steam.

“From the perspective of price action and on-chain distribution, the pace of the decline is indeed decelerating,” Tim Sun, senior researcher at HashKey Group, told Decrypt. “However, we have yet to see a signal for

4 days ago

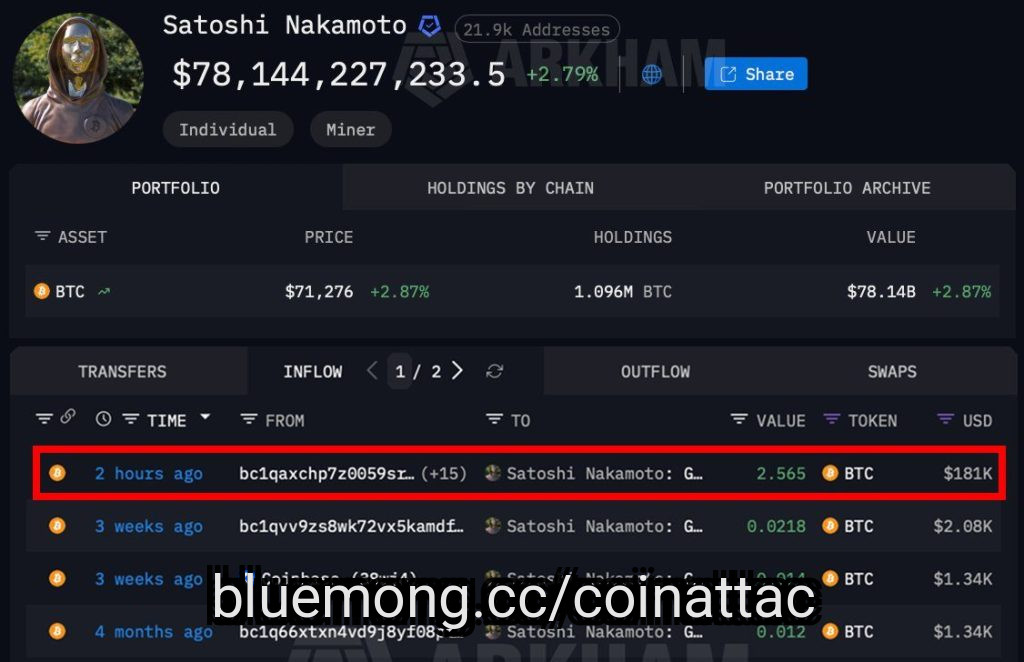

A sudden transfer to a wallet tied to Satoshi Nakamoto just sent a wave of speculation through the crypto world and briefly shook confidence in the current Bitcoin rally.

Out of nowhere, a random wallet sent 2.56 BTC, worth over $176,000, to one of the most iconic addresses in Bitcoin’s history.

The move instantly triggered theories that Satoshi might still be alive and possibly preparing to move or even sell part of their enormous Bitcoin stash.

While the market didn’t crash, the timing of the transaction cast a shadow over bullish Bitcoin price predictions, showing just how quickly sentim

Out of nowhere, a random wallet sent 2.56 BTC, worth over $176,000, to one of the most iconic addresses in Bitcoin’s history.

The move instantly triggered theories that Satoshi might still be alive and possibly preparing to move or even sell part of their enormous Bitcoin stash.

While the market didn’t crash, the timing of the transaction cast a shadow over bullish Bitcoin price predictions, showing just how quickly sentim

4 days ago

In recent days, BlackRock has been at the center of extreme crypto-market turbulence, as its iShares Bitcoin Trust (IBIT) and related options saw record trading activity amid theories of leveraged hedge fund blowups and institutional hedging feedback loops.

These events spotlight how a single, rapidly growing bitcoin ETF can influence broader digital-asset price moves and risk management behavior across the market.

We’ll now examine how the crypto-driven volatility around BlackRock’s IBIT ETF shapes the company’s investment narrative and perceived risk profile.

Capitalize on the AI infrastr

These events spotlight how a single, rapidly growing bitcoin ETF can influence broader digital-asset price moves and risk management behavior across the market.

We’ll now examine how the crypto-driven volatility around BlackRock’s IBIT ETF shapes the company’s investment narrative and perceived risk profile.

Capitalize on the AI infrastr

4 days ago

Tech investors have a big decision to make these days. Should they chase after high-growth artificial intelligence (AI) start-ups with little in the way of profitability, or should they focus on entrenched tech leaders with billions of dollars in profits flowing in each year?

If revenue and profitability matter to you as an investor, then it's impossible not to sit up and take notice of Coinbase Global (NASDAQ: COIN). It's now on pace to post more than $2.5 billion in net income each year. And it has a brand-new "everything exchange" strategy that is positioning it for future growth ahead.

W

If revenue and profitability matter to you as an investor, then it's impossible not to sit up and take notice of Coinbase Global (NASDAQ: COIN). It's now on pace to post more than $2.5 billion in net income each year. And it has a brand-new "everything exchange" strategy that is positioning it for future growth ahead.

W

4 days ago

Bitcoin (CRYPTO: BTC) hasn't proven to be much of a safe-haven **** et this year. It's down around 20% since the start of 2026, as investors have been turning to gold and silver as ways to hedge their risk. The cryptocurrency has recently hit a new 52-week low of just over $60,000.

Back in April of last year, when the market was concerned about reciprocal tariffs weighing on the economy, Bitcoin reached lows of around $75,000, and ended up roaring back. Is the world's top cryptocurrency a no-brainer buy while it remains below that threshold?

Will AI create the world's first trillionaire? Our

Back in April of last year, when the market was concerned about reciprocal tariffs weighing on the economy, Bitcoin reached lows of around $75,000, and ended up roaring back. Is the world's top cryptocurrency a no-brainer buy while it remains below that threshold?

Will AI create the world's first trillionaire? Our

4 days ago

For Robert Kiyosaki, gold and Bitcoin have long shared the same role in his playbook: protection.

The "Rich Dad Poor Dad" author has spent years warning that fiat currencies, especially the U.S. dollar, steadily lose purchasing power over time.

As a frequent critic of central banks, debt-driven growth, and what he sees as systemic currency debasement, he argues hard ***** ets are the escape hatch.

Related: ***** yst says Bitcoin will meet or beat gold's market cap

Kiyosaki began speaking publicly about Bitcoin around 2018, often placing it alongside gold and silver. His framing is consist

The "Rich Dad Poor Dad" author has spent years warning that fiat currencies, especially the U.S. dollar, steadily lose purchasing power over time.

As a frequent critic of central banks, debt-driven growth, and what he sees as systemic currency debasement, he argues hard ***** ets are the escape hatch.

Related: ***** yst says Bitcoin will meet or beat gold's market cap

Kiyosaki began speaking publicly about Bitcoin around 2018, often placing it alongside gold and silver. His framing is consist

17 days ago

Bitcoin is staying surprisingly composed after a few ugly dumps, as Ether, XRP, and SOL follow the same path against the USD. Reading today’s notes, the recurring talk on yen intervention is ringing a bell, and it may dictate the crypto price action.

In the opening stretch of today’s session, Bitcoin, Ether, SOL, and XRP all have the same neutral sentiment. Shorts slightly outweighed longs as the price healing. Surprisingly, tokenized silver is the one that contributed to the short liquidations. But judging by the liquidation numbers alone, we see that volume is nonexistent at the moment.

(s

In the opening stretch of today’s session, Bitcoin, Ether, SOL, and XRP all have the same neutral sentiment. Shorts slightly outweighed longs as the price healing. Surprisingly, tokenized silver is the one that contributed to the short liquidations. But judging by the liquidation numbers alone, we see that volume is nonexistent at the moment.

(s

17 days ago

Bitcoin’s network hashrate fell to its lowest level in seven months over the weekend as a powerful winter storm swept across the United States, forcing miners to scale back operations amid surging energy demand and widespread power disruptions.

Key Takeaways:

A US winter storm pushed Bitcoin’s hashrate to a seven-month low as miners curtailed operations to ease grid strain.

Network power fell over 40% before partially recovering.

Miners scaled back operations to help stabilize electricity grids.

https://finance.yahoo.com/...

Key Takeaways:

A US winter storm pushed Bitcoin’s hashrate to a seven-month low as miners curtailed operations to ease grid strain.

Network power fell over 40% before partially recovering.

Miners scaled back operations to help stabilize electricity grids.

https://finance.yahoo.com/...

18 days ago

Bitcoin news shows signs that its long bottoming phase is fading after months of sideways action. Bitcoin USD hovered near recent highs this week as volatility stayed muted, a pattern traders often see before a larger move. The setup matters because long consolidations often decide whether the next chapter brings relief or another shakeout.

The backdrop feels familiar. ETF momentum, post-crash healing, and long-term halving narratives all sit in the background at once. For beginners, this mix can feel noisy, so let’s slow it down.

DISCOVER: Top Ethereum Meme Coins to Buy in 2026

1. ETF pres

The backdrop feels familiar. ETF momentum, post-crash healing, and long-term halving narratives all sit in the background at once. For beginners, this mix can feel noisy, so let’s slow it down.

DISCOVER: Top Ethereum Meme Coins to Buy in 2026

1. ETF pres

18 days ago

Bitcoin is trading near $88,600, up about 1.2% on the day, as markets absorb a fresh wave of institutional and regulatory developments that reinforce long-term conviction despite ongoing volatility.

With a market capitalization of $1.77 trillion and nearly 19.98 million BTC already in circulation, recent price action points to stabilization rather than stress following last week’s pullback from the $95,000 area.

Japan-based Bitcoin treasury firm Metaplanet raised its revenue and operating profit outlook for 2025 and 2026, even after booking a $680–$700 million non-cash Bitcoin impairment tie

With a market capitalization of $1.77 trillion and nearly 19.98 million BTC already in circulation, recent price action points to stabilization rather than stress following last week’s pullback from the $95,000 area.

Japan-based Bitcoin treasury firm Metaplanet raised its revenue and operating profit outlook for 2025 and 2026, even after booking a $680–$700 million non-cash Bitcoin impairment tie

18 days ago

Bitcoin Jobs Grew 6% in 2025 With Non-Dev Roles Most-Posted

The most in-demand, non-developer Bitcoin job openings included product manager, executive **** istant, marketing manager, director and product designer.

COINTELEGRAPH IN YOUR SOCIAL FEED

Crypto companies' demand for Bitcoin-savvy workers reportedly increased 6% last year, with most job listings focused on non-developer roles.

A total of 1,801 Bitcoin-related positions were listed in 2025, up from 1,707 the year before, according to Bitvocation’s 2025 Bitcoin Jobs Data report.

The Bitcoin job opportunities were spread across Bi

The most in-demand, non-developer Bitcoin job openings included product manager, executive **** istant, marketing manager, director and product designer.

COINTELEGRAPH IN YOUR SOCIAL FEED

Crypto companies' demand for Bitcoin-savvy workers reportedly increased 6% last year, with most job listings focused on non-developer roles.

A total of 1,801 Bitcoin-related positions were listed in 2025, up from 1,707 the year before, according to Bitvocation’s 2025 Bitcoin Jobs Data report.

The Bitcoin job opportunities were spread across Bi

18 days ago

Both FBTC and ETHA charge the same 0.25% expense ratio, but FBTC is larger by ***** ets under management

ETHA posted a smaller one-year loss than FBTC, yet saw a much steeper maximum drawdown

Both funds track the price of a single crypto ***** et, with FBTC focused on bitcoin and ETHA on ether

These 10 stocks could mint the next wave of millionaires ›

FIDELITY WISE ORIGIN BITCOIN FUND (NYSEMKT:FBTC) and iShares Ethereum Trust ETF (NASDAQ:ETHA) both offer pure-play crypto exposure at identical expense ratios, but differ in ***** et focus, risk profile, and scale.

https://finance.yahoo.co

ETHA posted a smaller one-year loss than FBTC, yet saw a much steeper maximum drawdown

Both funds track the price of a single crypto ***** et, with FBTC focused on bitcoin and ETHA on ether

These 10 stocks could mint the next wave of millionaires ›

FIDELITY WISE ORIGIN BITCOIN FUND (NYSEMKT:FBTC) and iShares Ethereum Trust ETF (NASDAQ:ETHA) both offer pure-play crypto exposure at identical expense ratios, but differ in ***** et focus, risk profile, and scale.

https://finance.yahoo.co

18 days ago

Bitcoin holders have experienced over $4.5 billion in realized losses following the cryptocurrency’s dramatic decline from above $120,000 to below $90,000, which marks the highest level of capitulation since the 2022 bear market.

The Bitcoin price prediction indicator shows that the price might be bracing for another drop below $80k because the last time this much realized losses occurred in Bitcoin, the price dropped more than 50% to $28,000 from $69k.

The exodus from Bitcoin continues through institutional channels, with U.S.-based Bitcoin ETFs recording $1.33 billion in net outflows over

The Bitcoin price prediction indicator shows that the price might be bracing for another drop below $80k because the last time this much realized losses occurred in Bitcoin, the price dropped more than 50% to $28,000 from $69k.

The exodus from Bitcoin continues through institutional channels, with U.S.-based Bitcoin ETFs recording $1.33 billion in net outflows over

18 days ago

BlackRock, the world’s largest ******* et manager, has filed to launch a second Bitcoin-focused exchange-traded product that would give investors exposure to the cryptocurrency — along with a little yield.

The iShares Bitcoin Premium Income ETF would feature Bitcoin, cash, and shares of BlackRock’s two-year-old Bitcoin ETP, the iShares Bitcoin Trust, or IBIT.

To generate the “monthly premium income” for the new ETP, BlackRock would sell call options on the IBIT shares, according to the filing.

“Although the Shares [in the iShares Bitcoin Premium Income ETF] are not the equivalent of a direc

The iShares Bitcoin Premium Income ETF would feature Bitcoin, cash, and shares of BlackRock’s two-year-old Bitcoin ETP, the iShares Bitcoin Trust, or IBIT.

To generate the “monthly premium income” for the new ETP, BlackRock would sell call options on the IBIT shares, according to the filing.

“Although the Shares [in the iShares Bitcoin Premium Income ETF] are not the equivalent of a direc

18 days ago

A new Bitcoin price prediction has been put forward following a long-term technical ****** ysis shared on the social media platform...

Bitcoin price extended losses and traded below $88,500. BTC is consolidating losses and might attempt a recovery wave if it...

The calls of a potential Bitcoin supercycle in 2026 intensified over the past week after former Binance CEO Changpeng ‘CZ’...

https://www.newsbtc.com/ne...

Bitcoin price extended losses and traded below $88,500. BTC is consolidating losses and might attempt a recovery wave if it...

The calls of a potential Bitcoin supercycle in 2026 intensified over the past week after former Binance CEO Changpeng ‘CZ’...

https://www.newsbtc.com/ne...

18 days ago

Ethereum remains the top platform for developing decentralized apps.

Polkadot provides developers more flexibility with its parachains.

The blue chip leader might have more upside potential than the tiny underdog.

10 stocks we like better than Ethereum ›

Ethereum (CRYPTO: ETH) and Polkadot (CRYPTO: DOT) generally attract different types of cryptocurrency investors. Ether, the native token of the Ethereum blockchain, is the world's second-most-valuable cryptocurrency after Bitcoin (CRYPTO: BTC). It's often considered a "blue chip" token, more stable than smaller altcoins or meme coins. A $1

Polkadot provides developers more flexibility with its parachains.

The blue chip leader might have more upside potential than the tiny underdog.

10 stocks we like better than Ethereum ›

Ethereum (CRYPTO: ETH) and Polkadot (CRYPTO: DOT) generally attract different types of cryptocurrency investors. Ether, the native token of the Ethereum blockchain, is the world's second-most-valuable cryptocurrency after Bitcoin (CRYPTO: BTC). It's often considered a "blue chip" token, more stable than smaller altcoins or meme coins. A $1

18 days ago

Despite the current downturn for crypto, Strategy added even more Bitcoin to its collection. The company bought more than 2,900 Bitcoin last week, bringing its total to over 712,000, according to an X post by cofounder Michael Saylor. The move follows a more than $2 billion purchase earlier this month.

Strategy is the first and biggest digital **** et treasury, or a type of company that acquires and holds on to large amounts of crypto. Saylor’s company began investing in Bitcoin in 2020 and now holds more than 3% of the total supply. This business model has confronted major challenges in the

Strategy is the first and biggest digital **** et treasury, or a type of company that acquires and holds on to large amounts of crypto. Saylor’s company began investing in Bitcoin in 2020 and now holds more than 3% of the total supply. This business model has confronted major challenges in the

18 days ago

Another former crypto miner is quietly making the case that pivoting to AI may be the smartest survival move in today’s market.

This time, the proof point is CoreWeave (NASDAQ: CRWV), a firm that began life as a Bitcoin mining operation and is now pulling in billions from Big Tech.

Related: What is Bitcoin mining? Explained

CoreWeave didn’t start out as an AI darling.

The company was founded in 2017 under the name Atlantic Crypto, initially focused on Bitcoin mining. But after the 2018 crypto crash exposed how fragile mining economics could be, the team made a decisive pivot.

https://fi

This time, the proof point is CoreWeave (NASDAQ: CRWV), a firm that began life as a Bitcoin mining operation and is now pulling in billions from Big Tech.

Related: What is Bitcoin mining? Explained

CoreWeave didn’t start out as an AI darling.

The company was founded in 2017 under the name Atlantic Crypto, initially focused on Bitcoin mining. But after the 2018 crypto crash exposed how fragile mining economics could be, the team made a decisive pivot.

https://fi

18 days ago

I remember the excitement in the market when BlackRock (NYSE: BLK) launched its U.S. spot exchange-traded fund (ETF) linked to Bitcoin (BTC) in January 2024.

After all, the world's largest ***** et manager had decided to launch a Bitcoin product after much hesitation and the move had indicated Wall Street finally embracing cryptocurrency.

Related: BlackRock reveals retail traders' next portfolio move

More than two years have passed since then, and BlackRock's iShares Bitcoin Trust (Nasdaq: IBIT) has accumulated $62.9 billion in net inflow as of Jan. 23, as per the onchain ***** ytics platfo

After all, the world's largest ***** et manager had decided to launch a Bitcoin product after much hesitation and the move had indicated Wall Street finally embracing cryptocurrency.

Related: BlackRock reveals retail traders' next portfolio move

More than two years have passed since then, and BlackRock's iShares Bitcoin Trust (Nasdaq: IBIT) has accumulated $62.9 billion in net inflow as of Jan. 23, as per the onchain ***** ytics platfo

18 days ago

Bitcoin’s network hit an unusual speed **** p over the weekend, not because of code, markets or a Fed policy change, but because the physical world intervened.

A sprawling winter storm strained regional power grids and knocked out electricity for hundreds of thousands of households.

The disruption briefly spilled into crypto infrastructure, as some US-based Bitcoin miners cut power use and the network’s block production slowed, without sparking market panic.

Related: U.S. Government Targets Russia’s Crypto Mining Industry for Sanctions Amid Ukraine War

Winter Storm Fern swept across a wide

A sprawling winter storm strained regional power grids and knocked out electricity for hundreds of thousands of households.

The disruption briefly spilled into crypto infrastructure, as some US-based Bitcoin miners cut power use and the network’s block production slowed, without sparking market panic.

Related: U.S. Government Targets Russia’s Crypto Mining Industry for Sanctions Amid Ukraine War

Winter Storm Fern swept across a wide

18 days ago

The stability of a major global currency is hanging in the balance, and the ripple effects are zeroing in on Bitcoin, at least in the short-term.

This shift revolves around the potential for a coordinated currency intervention by the Federal Reserve, according to a Bloomberg report. After the New York Fed conducted a rate check—a procedural move often preceding market action—the ***** anese yen surged 3.39% from last Friday’s low. It now trades at 153.95 yen to the dollar, a level not seen since early November 2025.

This matters because a stronger yen threatens to unwind one of the world’s m

This shift revolves around the potential for a coordinated currency intervention by the Federal Reserve, according to a Bloomberg report. After the New York Fed conducted a rate check—a procedural move often preceding market action—the ***** anese yen surged 3.39% from last Friday’s low. It now trades at 153.95 yen to the dollar, a level not seen since early November 2025.

This matters because a stronger yen threatens to unwind one of the world’s m

18 days ago

BlackRock could soon debut its iShares Bitcoin Premium Income ETF, according to a registration statement filed with the SEC on Friday.

The new ETF will track the "performance of the price of Bitcoin while providing premium income through an actively managed strategy of writing (selling) call options on IBIT shares and, from time to time, on indices that track spot bitcoin exchange-traded products ('ETPs'), including [iShares Bitcoin Trust] (such indices, 'ETP Indices')," the issuer said in its SEC filing.

In practice, this means the fund sells options that give other investors the right to b

The new ETF will track the "performance of the price of Bitcoin while providing premium income through an actively managed strategy of writing (selling) call options on IBIT shares and, from time to time, on indices that track spot bitcoin exchange-traded products ('ETPs'), including [iShares Bitcoin Trust] (such indices, 'ETP Indices')," the issuer said in its SEC filing.

In practice, this means the fund sells options that give other investors the right to b

18 days ago

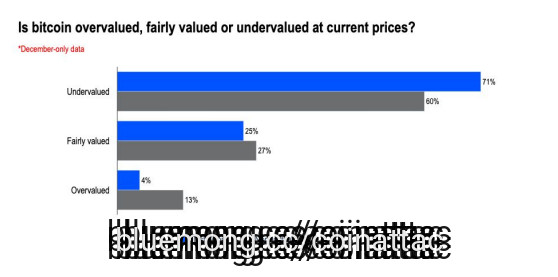

Most institutional investors remain bullish on Bitcoin despite brutal fourth-quarter volatility that erased nearly a third of the ***** et’s value from recent peaks.

A new Coinbase Institutional and Glassnode survey found 70% of institutions view BTC as undervalued, even after the token dropped from above $125,000 in early October 2025 to trade around $90,000 by year-end, while 60% of non-institutional investors share that conviction.

The findings come from a quarterly poll of 148 global investors, split between 75 institutions and 73 non-institutions, conducted between December 10, 2025, an

A new Coinbase Institutional and Glassnode survey found 70% of institutions view BTC as undervalued, even after the token dropped from above $125,000 in early October 2025 to trade around $90,000 by year-end, while 60% of non-institutional investors share that conviction.

The findings come from a quarterly poll of 148 global investors, split between 75 institutions and 73 non-institutions, conducted between December 10, 2025, an

18 days ago

Bitcoin is trading near $87,700, down about 1% on the day, yet Robert Kiyosaki remains unmoved by short-term price swings. The Rich Dad Poor Dad author says he continues buying Bitcoin and Ethereum regardless of volatility, arguing that price matters less than the direction of the global financial system.

In a recent post, Kiyosaki pointed to two forces shaping his strategy: the rising US national debt, now above $38.4 trillion, and the steady erosion of the dollar’s purchasing power. From his perspective, daily price movements are a distraction.

As debt expands and deficits deepen, scarce *

In a recent post, Kiyosaki pointed to two forces shaping his strategy: the rising US national debt, now above $38.4 trillion, and the steady erosion of the dollar’s purchasing power. From his perspective, daily price movements are a distraction.

As debt expands and deficits deepen, scarce *

18 days ago

Bitcoin’s outlook deteriorated over the weekend, with Monday volatility triggering a $750 million crypto liquidation spike.

A closer look at the data shows that over 77% of the liquidations came from long positions, according to CoinGlass data, a trend that has been dominant over the past week due to top crypto’s sustained slide lower.

Bitcoin’s drop from last week’s local top of $95,400 saw it drop to lows of $86,126 over the weekend, per CoinGecko data, before selling pressure pushed it to its current price of around as $87,700, down 1% on the day.

Derivatives participation has remained t

A closer look at the data shows that over 77% of the liquidations came from long positions, according to CoinGlass data, a trend that has been dominant over the past week due to top crypto’s sustained slide lower.

Bitcoin’s drop from last week’s local top of $95,400 saw it drop to lows of $86,126 over the weekend, per CoinGecko data, before selling pressure pushed it to its current price of around as $87,700, down 1% on the day.

Derivatives participation has remained t

Sponsored by

Blue Mong

3 months ago