Administrator pinned this post

3 months ago

Get $10 for Every 100 Followers!

Don't miss out on this limited-time offer! For every 100 followers you gain, you'll receive $10.

Hurry, the campaign ends without prior notice! Be sure to take advantage before it’s too late.

For more details, check the banner.

Don't miss out on this limited-time offer! For every 100 followers you gain, you'll receive $10.

Hurry, the campaign ends without prior notice! Be sure to take advantage before it’s too late.

For more details, check the banner.

1 month ago

As 2025 came to a close, subtle changes in Federal Reserve activity started to catch the attention of traders watching both macro markets and crypto. Unusual moves in short-term funding and a series of quiet policy adjustments suggested that liquidity pressures might be easing. For some observers, that raised the possibility that Bitcoin could start moving higher before traditional markets show clearer signs of recovery in 2026.

On December 31, 2025, banks drew a record $74.6 billion from the Federal Reserve’s Standing Repo Facility. That spike pointed to stress in short-term funding markets

On December 31, 2025, banks drew a record $74.6 billion from the Federal Reserve’s Standing Repo Facility. That spike pointed to stress in short-term funding markets

1 month ago

After a turbulent end to 2025, that has left bitcoin (BTC-USD) swinging between optimism and caution, will the world’s largest cryptocurrency sink back toward $50,000 or push to new highs above $125,000 (£93,655) in 2026? With monetary policy, liquidity, regulation, and institutional demand all in flux, ******* ysts say the answer may depend on how these forces unfold quarter by quarter next year.

Fabian Dori, chief investment officer at Sygnum Bank, believes the opening months of 2026 could be broadly supportive for bitcoin (BTC-USD), driven by improving macro conditions and easing fear acro

Fabian Dori, chief investment officer at Sygnum Bank, believes the opening months of 2026 could be broadly supportive for bitcoin (BTC-USD), driven by improving macro conditions and easing fear acro

1 month ago

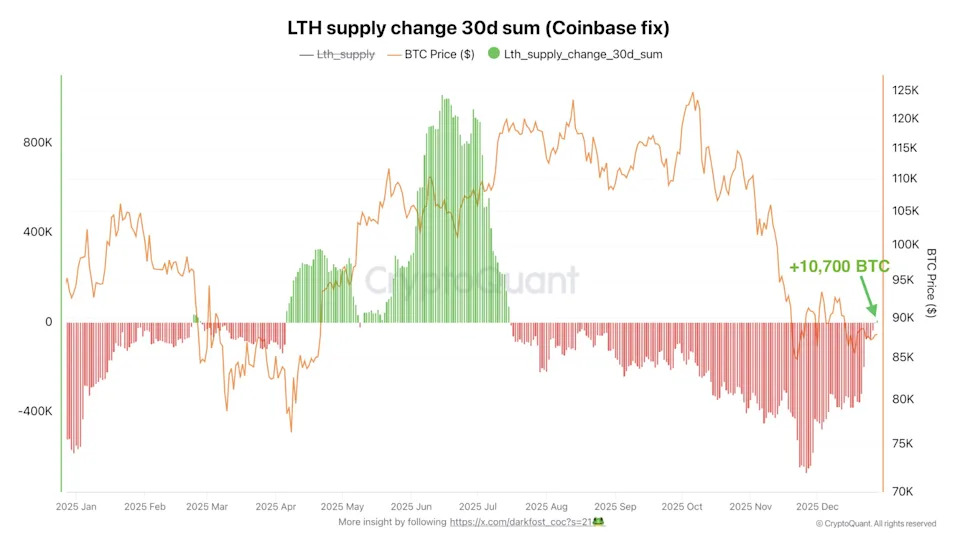

Bitcoin started 2026 stuck near $88,000, extending weeks of sideways trading. While price action looks stagnant, on-chain data suggests the market may be quietly shifting beneath the surface.

Three indicators from CryptoQuant point to easing sell pressure, even as macro uncertainty continues to cap upside momentum.

Bitcoin’s price has struggled to reclaim key resistance after a sharp pullback in late 2025. The lack of follow-through buying has kept sentiment fragile, with traders waiting for confirmation that the correction has run its course.

The first signal comes from long-term holder (L

Three indicators from CryptoQuant point to easing sell pressure, even as macro uncertainty continues to cap upside momentum.

Bitcoin’s price has struggled to reclaim key resistance after a sharp pullback in late 2025. The lack of follow-through buying has kept sentiment fragile, with traders waiting for confirmation that the correction has run its course.

The first signal comes from long-term holder (L

1 month ago

Key Takeaways

Bitcoin closed 2025 as the first negative post-halving year ever.

Institutional dominance and macro factors muted the halving impact in 2025.

4-year cycle evolving, not dead; expect longer, less volatile patterns ahead.

Bitcoin (BTC) closed 2025 with a negative yearly return for the first time in a post-halving year, marking a significant deviation from historical patterns.

https://finance.yahoo.com/...

Bitcoin closed 2025 as the first negative post-halving year ever.

Institutional dominance and macro factors muted the halving impact in 2025.

4-year cycle evolving, not dead; expect longer, less volatile patterns ahead.

Bitcoin (BTC) closed 2025 with a negative yearly return for the first time in a post-halving year, marking a significant deviation from historical patterns.

https://finance.yahoo.com/...

2 months ago

Bitcoin Price Capped By Shifting Maco Conditions, Not Whale Selling

Bitcoin’s technical and onchain market structure was robust throughout 2025, but ever-shifting macroeconomic conditions eventually put a cap on BTC price. Will the trend shift in 2026?

COINTELEGRAPH IN YOUR SOCIAL FEED

Bitcoin’s 2024–2025 price action highlighted a disconnect between improving high-timeframe onchain structure and restrictive macroeconomic conditions. While crypto-native liquidity and supply dynamics strengthened during Bitcoin’s

BTC

$87,694

2024 rally, external variables, like elevated real yields and

Bitcoin’s technical and onchain market structure was robust throughout 2025, but ever-shifting macroeconomic conditions eventually put a cap on BTC price. Will the trend shift in 2026?

COINTELEGRAPH IN YOUR SOCIAL FEED

Bitcoin’s 2024–2025 price action highlighted a disconnect between improving high-timeframe onchain structure and restrictive macroeconomic conditions. While crypto-native liquidity and supply dynamics strengthened during Bitcoin’s

BTC

$87,694

2024 rally, external variables, like elevated real yields and

2 months ago

Bitcoin held near $89,127 in thin Boxing Day trade as Asian stocks edged higher and silver stayed in the spotlight after notching fresh record highs this week, with investors still leaning into the year-end risk bid.

With several Asia Pacific exchanges shut for the holiday, investors took cues from the last full session, when MSCI’s broadest index of Asia Pacific shares outside ***** an rose 0.35%.

Crypto traders framed the quieter tape as a liquidity story as much as a macro one. Gabriel Selby, head of research at CF Benchmarks, said Bitcoin remained pinned under a key level as markets drif

With several Asia Pacific exchanges shut for the holiday, investors took cues from the last full session, when MSCI’s broadest index of Asia Pacific shares outside ***** an rose 0.35%.

Crypto traders framed the quieter tape as a liquidity story as much as a macro one. Gabriel Selby, head of research at CF Benchmarks, said Bitcoin remained pinned under a key level as markets drif

2 months ago

Bitcoin held near $89,127 in thin Boxing Day trade as Asian stocks edged higher and silver stayed in the spotlight after notching fresh record highs this week, with investors still leaning into the year-end risk bid.

With several Asia Pacific exchanges shut for the holiday, investors took cues from the last full session, when MSCI’s broadest index of Asia Pacific shares outside **** an rose 0.35%.

Crypto traders framed the quieter tape as a liquidity story as much as a macro one. Gabriel Selby, head of research at CF Benchmarks, said Bitcoin remained pinned under a key level as markets drift

With several Asia Pacific exchanges shut for the holiday, investors took cues from the last full session, when MSCI’s broadest index of Asia Pacific shares outside **** an rose 0.35%.

Crypto traders framed the quieter tape as a liquidity story as much as a macro one. Gabriel Selby, head of research at CF Benchmarks, said Bitcoin remained pinned under a key level as markets drift

2 months ago

2025 has been a largely strong year for the cryptocurrency market.

Bitcoin climbed to a new all-time high of $126,000 during the year, alongside the launch of several new altcoin-focused exchange-traded funds and the establishment of a Bitcoin Strategic Reserve in the United States.

The period was also marked by continued accumulation of Bitcoin by corporate treasury holders such as Strategy, as well as a series of broader macroeconomic developments that influenced digital ******* et markets.

https://invezz.com/news/20...

Bitcoin climbed to a new all-time high of $126,000 during the year, alongside the launch of several new altcoin-focused exchange-traded funds and the establishment of a Bitcoin Strategic Reserve in the United States.

The period was also marked by continued accumulation of Bitcoin by corporate treasury holders such as Strategy, as well as a series of broader macroeconomic developments that influenced digital ******* et markets.

https://invezz.com/news/20...

2 months ago

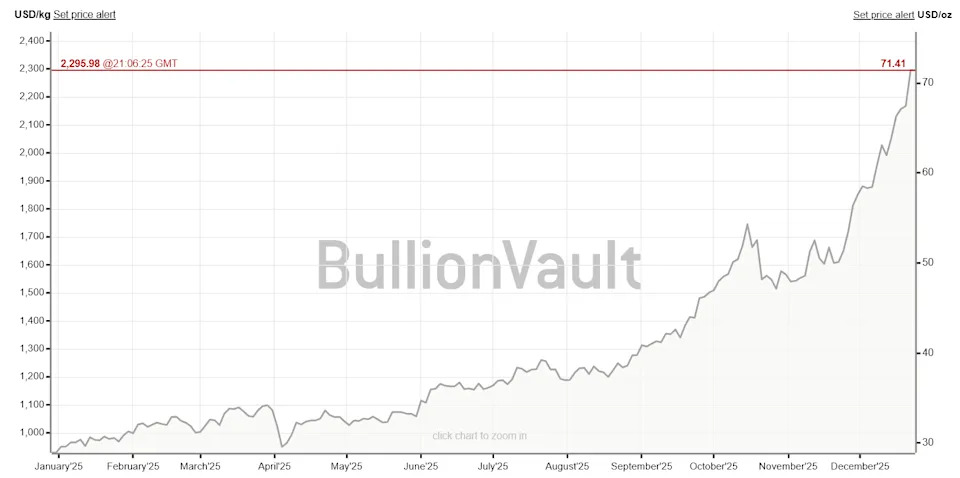

Silver markets sent a clear signal on Christmas Day. While Bitcoin traded quietly in thin holiday liquidity, silver prices in China surged to record local levels, driven by tight physical supply and strong industrial demand.

The divergence highlights a growing macro theme. During periods of scarcity and geopolitical stress, capital is flowing toward hard ***** ets rather than digital alternatives.

The latest silver move originated in China, where local prices reached record levels on December 25. Evidently, China is facing a shortage of physical silver.

Globally, spot silver hovered near re

The divergence highlights a growing macro theme. During periods of scarcity and geopolitical stress, capital is flowing toward hard ***** ets rather than digital alternatives.

The latest silver move originated in China, where local prices reached record levels on December 25. Evidently, China is facing a shortage of physical silver.

Globally, spot silver hovered near re

2 months ago

Bitcoin price action has remained mixed in recent sessions, reflecting uncertainty across global markets. At the time of writing, broader risk cues offer little direction for short-term momentum.

However, one notable signal is emerging from gold, whose recent strength may be positioning Bitcoin for a renewed rally if historical correlations continue to hold.

Bitcoin has increasingly mirrored gold’s trajectory over the past year, reinforcing its role as a macro-sensitive ****** et. Historically, sharp advances in gold prices have often preceded upside moves in Bitcoin. This relationship stems

However, one notable signal is emerging from gold, whose recent strength may be positioning Bitcoin for a renewed rally if historical correlations continue to hold.

Bitcoin has increasingly mirrored gold’s trajectory over the past year, reinforcing its role as a macro-sensitive ****** et. Historically, sharp advances in gold prices have often preceded upside moves in Bitcoin. This relationship stems

2 months ago

Solana’s price action this year has followed a clear but uncomfortable pattern. After pushing to a new all-time high around...

Macro trader plur daddy (plur_daddy) argues bitcoin’s 2026 setup is less about crypto-specific catalysts and more about whether US liquidity...

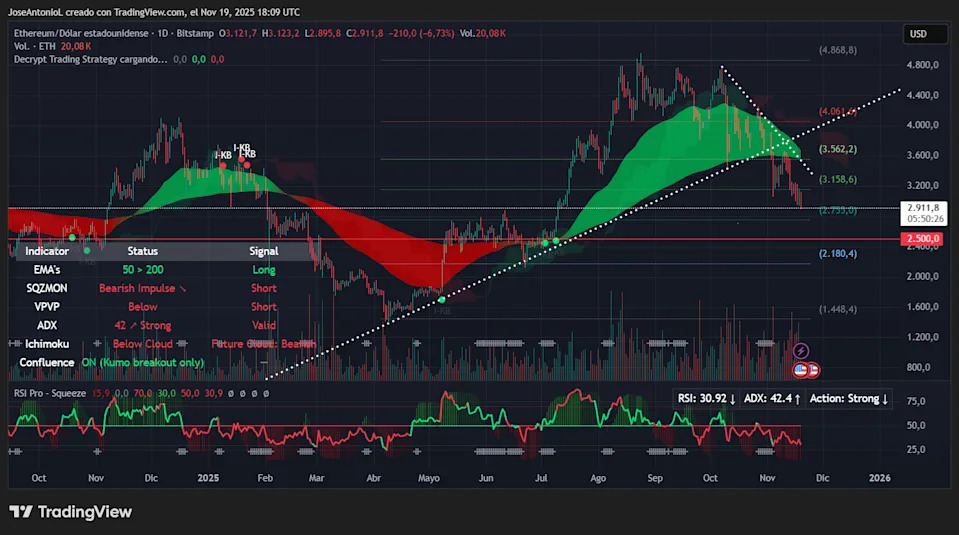

After being rejected from the $3,000 level, Ethereum (ETH) is trying to hold a key support zone and build a...

https://www.newsbtc.com/ne...

Macro trader plur daddy (plur_daddy) argues bitcoin’s 2026 setup is less about crypto-specific catalysts and more about whether US liquidity...

After being rejected from the $3,000 level, Ethereum (ETH) is trying to hold a key support zone and build a...

https://www.newsbtc.com/ne...

2 months ago

Silver emerged as one of the strongest-performing major **** ets in 2025, sharply outperforming both gold and Bitcoin.

The rally was not driven by speculation alone. Instead, it reflected a rare convergence of macroeconomic shifts, industrial demand, and geopolitical pressure that could extend into 2026.

By late December 2025, silver traded near $71 per ounce, up more than 120% year-to-date. Gold rose roughly 60% over the same period, while Bitcoin ended the year slightly lower after a volatile run that peaked in October.

Silver price entered 2025 near $29 per ounce and climbed steadily t

The rally was not driven by speculation alone. Instead, it reflected a rare convergence of macroeconomic shifts, industrial demand, and geopolitical pressure that could extend into 2026.

By late December 2025, silver traded near $71 per ounce, up more than 120% year-to-date. Gold rose roughly 60% over the same period, while Bitcoin ended the year slightly lower after a volatile run that peaked in October.

Silver price entered 2025 near $29 per ounce and climbed steadily t

2 months ago

Bitcoin has fallen below the $90,000 level, extending a pullback from its recent peak near $120,000 as investors grapple with uncertain macroeconomic signals and uneven liquidity conditions.

Key Takeaways:

According to Linh Tran, market ******* yst at XS.com, Bitcoin’s recent price action underscores the market’s sensitivity to monetary policy expectations rather than headline economic data.

While US inflation has eased from last year’s highs, the latest consumer price index reading of 2.7% suggests that the disinflation process remains slow and uneven, forcing “the Fed to maintain a cautio

Key Takeaways:

According to Linh Tran, market ******* yst at XS.com, Bitcoin’s recent price action underscores the market’s sensitivity to monetary policy expectations rather than headline economic data.

While US inflation has eased from last year’s highs, the latest consumer price index reading of 2.7% suggests that the disinflation process remains slow and uneven, forcing “the Fed to maintain a cautio

2 months ago

Bitcoin rallies thwarted by fading Fed rate cut odds, softening US macro

Bitcoin continued to sell near $90,000 as investors reacted to weak US jobs data and slowing economic growth by shifting into safer ***** ets.

Key takeaways:

Strong demand for US Treasurys and lower odds of a Fed rate cut indicate that investors are shifting toward safer ***** ets, reducing interest in Bitcoin.

Economic weakness in ***** an and softer US job data add pressure to Bitcoin, limiting its use as a hedge in the near term.

Bitcoin

BTC

$88,227

has repeatedly failed to hold above the $92,000 level over t

Bitcoin continued to sell near $90,000 as investors reacted to weak US jobs data and slowing economic growth by shifting into safer ***** ets.

Key takeaways:

Strong demand for US Treasurys and lower odds of a Fed rate cut indicate that investors are shifting toward safer ***** ets, reducing interest in Bitcoin.

Economic weakness in ***** an and softer US job data add pressure to Bitcoin, limiting its use as a hedge in the near term.

Bitcoin

BTC

$88,227

has repeatedly failed to hold above the $92,000 level over t

2 months ago

Fresh US economic data is sending a clear but nuanced signal to markets. Inflation pressures are easing, but consumers remain under strain.

For Bitcoin and the broader crypto market, that mix points to improving macro conditions, tempered by near-term volatility.

US consumer sentiment edged up to 52.9 in December, slightly higher than November but still nearly 30% lower than a year ago, according to the University of Michigan.

At the same time, inflation expectations continued to fall. Short-term expectations dropped to 4.2%, while long-term expectations eased to 3.2%.

For markets, those i

For Bitcoin and the broader crypto market, that mix points to improving macro conditions, tempered by near-term volatility.

US consumer sentiment edged up to 52.9 in December, slightly higher than November but still nearly 30% lower than a year ago, according to the University of Michigan.

At the same time, inflation expectations continued to fall. Short-term expectations dropped to 4.2%, while long-term expectations eased to 3.2%.

For markets, those i

2 months ago

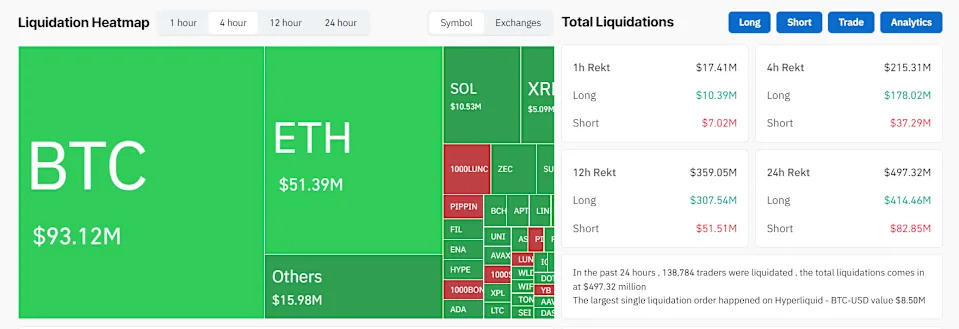

Bitcoin slipped under $90,000 this week as liquidation pressure, weak ETF demand, and macro uncertainty converged.

The fall erased gains from earlier attempts to reclaim the $94,000–$95,000 zone, marking the second major breakdown this month.

The catalyst was a cascade of forced long liquidations. Nearly $500 million was wiped out across exchanges, including around $420 million in long positions, and over 140,000 traders were liquidated in a 24-hour window.

ETF flows failed to absorb the selling. BlackRock’s iShares Bitcoin Trust recorded six straight weeks of outflows totaling more than $2

The fall erased gains from earlier attempts to reclaim the $94,000–$95,000 zone, marking the second major breakdown this month.

The catalyst was a cascade of forced long liquidations. Nearly $500 million was wiped out across exchanges, including around $420 million in long positions, and over 140,000 traders were liquidated in a 24-hour window.

ETF flows failed to absorb the selling. BlackRock’s iShares Bitcoin Trust recorded six straight weeks of outflows totaling more than $2

2 months ago

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Bitcoin is starting December on weaker footing as risk ****** ets wobble and the year-end rally narrative gives way to a market working through heavy volatility. BTC has fallen into the mid-$80,000s after trading above $125,000 in early October, leaving the token roughly 30% off the highs and giving back a large portion of its 2025 outperformance.

The tone has shifted from momentum to repair as traders reassess positioning, ETF flows, and macro pressure.

Against that backdrop, we ran Bitcoin

Bitcoin is starting December on weaker footing as risk ****** ets wobble and the year-end rally narrative gives way to a market working through heavy volatility. BTC has fallen into the mid-$80,000s after trading above $125,000 in early October, leaving the token roughly 30% off the highs and giving back a large portion of its 2025 outperformance.

The tone has shifted from momentum to repair as traders reassess positioning, ETF flows, and macro pressure.

Against that backdrop, we ran Bitcoin

2 months ago

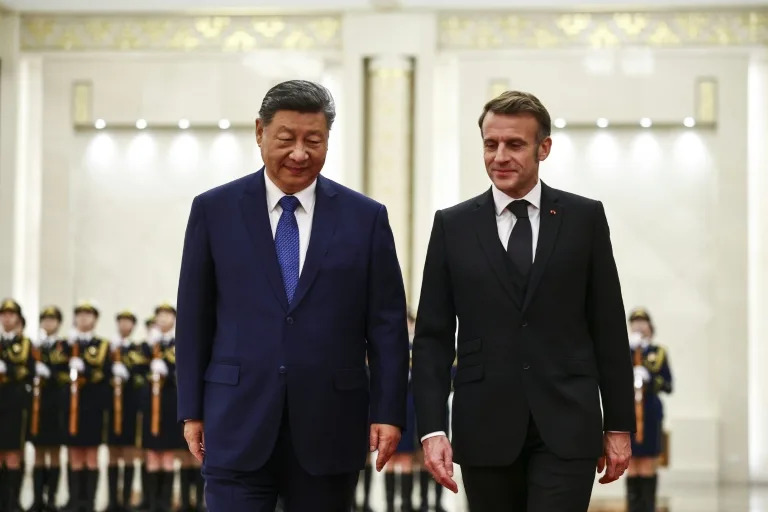

Pandas and ping-pong: Macron ending China visit on lighter note

An ancient dam, pandas and ping-pong: French leader Emmanuel Macron concluded his fourth state visit to China on Friday, striking a more relaxed note in the city of Chengdu after tough discussions on Ukraine and trade with his counterpart Xi Jinping a day earlier.

Far from the imposing Great Hall of the People in Beijing where the two leaders held talks, Xi and First Lady Peng Liyuan showed Macron and his wife Brigitte around the centuries-old Dujiangyan Dam, a World Heritage Site set against the mountainous landscape of Sichu

An ancient dam, pandas and ping-pong: French leader Emmanuel Macron concluded his fourth state visit to China on Friday, striking a more relaxed note in the city of Chengdu after tough discussions on Ukraine and trade with his counterpart Xi Jinping a day earlier.

Far from the imposing Great Hall of the People in Beijing where the two leaders held talks, Xi and First Lady Peng Liyuan showed Macron and his wife Brigitte around the centuries-old Dujiangyan Dam, a World Heritage Site set against the mountainous landscape of Sichu

2 months ago

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Ethereum is starting December in Bitcoin's shadow. The token is selling off with the rest of crypto but holding key support zones as traders wait for signs of stabilization in risk ******* ets. It has lagged Bitcoin on the way up this cycle, giving the tape less euphoria but also less excess to unwind.

The tone shifted from quiet strength to cautious consolidation as macro pressure pulled the entire crypto complex lower.

Against that backdrop, we ran Ethereum through an AI price-prediction a

Ethereum is starting December in Bitcoin's shadow. The token is selling off with the rest of crypto but holding key support zones as traders wait for signs of stabilization in risk ******* ets. It has lagged Bitcoin on the way up this cycle, giving the tape less euphoria but also less excess to unwind.

The tone shifted from quiet strength to cautious consolidation as macro pressure pulled the entire crypto complex lower.

Against that backdrop, we ran Ethereum through an AI price-prediction a

2 months ago

A rare technical signal that preceded Bitcoin’s explosive rally in late 2023 has reappeared, with the Bollinger Bandwidth indicator dipping below 100 and flashing a green alert that could reshape Bitcoin price prediction for the remainder of December.

Macro strategist Gert van Lagen observed that every previous trigger of this indicator has been followed by a direct parabolic leg upward, raising expectations of a potential 40% surge before year-end.

Van Lagen noted the current setup mirrors Google’s parabolic run before its final blow-off wave ahead of the 2008 financial crisis, characterize

Macro strategist Gert van Lagen observed that every previous trigger of this indicator has been followed by a direct parabolic leg upward, raising expectations of a potential 40% surge before year-end.

Van Lagen noted the current setup mirrors Google’s parabolic run before its final blow-off wave ahead of the 2008 financial crisis, characterize

3 months ago

Key Takeaways

The sudden plunge erased billions in market value and triggered heavy liquidations.

Analysts pointed to the Bank of ****** an’s signals of a possible December rate hike and the weakening yen.

Bitcoin may retest support around $82,622 if the decline continues, ****** ysts said.

Bitcoin tumbled 5% in a matter of hours on Sunday, igniting a wave of speculation among traders who say the scale and speed of the drop defy any clear macro trigger.

https://finance.yahoo.com/...

The sudden plunge erased billions in market value and triggered heavy liquidations.

Analysts pointed to the Bank of ****** an’s signals of a possible December rate hike and the weakening yen.

Bitcoin may retest support around $82,622 if the decline continues, ****** ysts said.

Bitcoin tumbled 5% in a matter of hours on Sunday, igniting a wave of speculation among traders who say the scale and speed of the drop defy any clear macro trigger.

https://finance.yahoo.com/...

3 months ago

Bitcoin is trading at $90,733.75 today, down 0.85% in the past 24 hours, with a massive $53.3 billion in trading volume. As the world’s largest cryptocurrency, Bitcoin maintains a market cap above $1.81 trillion, supported by a circulating supply of 19.95 million BTC.

With only about one million coins left before the hard cap, every macro dip invites one recurring question: is this the final bottom before the next push toward $100,000?

Bitcoin’s weekly chart shows the market attempting to stabilize after a three-week decline. Price has bounced from the $91,651 Fibonacci 0.236 level, producin

With only about one million coins left before the hard cap, every macro dip invites one recurring question: is this the final bottom before the next push toward $100,000?

Bitcoin’s weekly chart shows the market attempting to stabilize after a three-week decline. Price has bounced from the $91,651 Fibonacci 0.236 level, producin

3 months ago

Bitcoin (BTC) could climb to $240,000 over the long term, according to a recent JPMorgan note ***** sing the ***** et’s evolving market structure.

The projection followed a weak stretch for the broader crypto market, with BTC falling from its early October peak of $126,000 to around $82,000 in November.

At the time of writing, BTC had stabilized near $86,610.

In the note, ***** ysts wrote that crypto markets are now influenced more by macroeconomic forces than by Bitcoin’s four-year halving cycle, which historically preceded major bull runs.

“Crypto is moving away from resembling a venture

The projection followed a weak stretch for the broader crypto market, with BTC falling from its early October peak of $126,000 to around $82,000 in November.

At the time of writing, BTC had stabilized near $86,610.

In the note, ***** ysts wrote that crypto markets are now influenced more by macroeconomic forces than by Bitcoin’s four-year halving cycle, which historically preceded major bull runs.

“Crypto is moving away from resembling a venture

3 months ago

Bitcoin (BTC) has lost its footing, both on an absolute basis and relative to U.S. equities.

According to Adrian Fritz, chief investment strategist at crypto investment firm 21Shares, the divergence between crypto and stocks comes down to macro pressure, investor sentiment and what he calls a “panda market” — not a full-blown crypto winter, but still bearish action.

“Technically, we’ve entered a bear market,” Fritz said in an interview with CoinDesk. Bitcoin has fallen more than 30% from its highs, breaching the 50-week moving average — a level that historically signals broader shifts in mar

According to Adrian Fritz, chief investment strategist at crypto investment firm 21Shares, the divergence between crypto and stocks comes down to macro pressure, investor sentiment and what he calls a “panda market” — not a full-blown crypto winter, but still bearish action.

“Technically, we’ve entered a bear market,” Fritz said in an interview with CoinDesk. Bitcoin has fallen more than 30% from its highs, breaching the 50-week moving average — a level that historically signals broader shifts in mar

3 months ago

Asia Market Open: Bitcoin Holds Near $92K As Strong Nvidia Earnings Calm AI...

Bitcoin held near $92,000 in Asian trading on Thursday, steadying after a bruising stretch, while a powerful tech-led rally swept across regional stock markets on the back of strong Nvidia earnings and easing fears of an AI bubble.

The token traded in a tight range as some dip buyers returned, but crypto volumes stayed cautious with traders still wary of macro risk and the next batch of US data.

The dollar edged higher ahead of a long-delayed jobs report, keeping risk appetite contained even as equities bounced

Bitcoin held near $92,000 in Asian trading on Thursday, steadying after a bruising stretch, while a powerful tech-led rally swept across regional stock markets on the back of strong Nvidia earnings and easing fears of an AI bubble.

The token traded in a tight range as some dip buyers returned, but crypto volumes stayed cautious with traders still wary of macro risk and the next batch of US data.

The dollar edged higher ahead of a long-delayed jobs report, keeping risk appetite contained even as equities bounced

3 months ago

Crypto traders and investors who bought near highs in recent months are getting absolutely rekt right now, as hype fades and the market bleeds.

Bitcoin is down to around $88,000, falling more than 20% over the last 30 days. The crypto market as a whole today fell to $3.04 trillion—down 4.82% in 24 hours—with 95% of all coins bleeding red. The Fear and Greed Index just hit 16, the lowest reading since April, firmly in extreme fear territory. To put this in perspective: Zcash is the only coin in the top 50 by market cap managing to stay green today, squeezing out a 4% gain.

And the macro pictu

Bitcoin is down to around $88,000, falling more than 20% over the last 30 days. The crypto market as a whole today fell to $3.04 trillion—down 4.82% in 24 hours—with 95% of all coins bleeding red. The Fear and Greed Index just hit 16, the lowest reading since April, firmly in extreme fear territory. To put this in perspective: Zcash is the only coin in the top 50 by market cap managing to stay green today, squeezing out a 4% gain.

And the macro pictu

3 months ago

Crypto market braces for Yen carry trades unwind as **** an's long-term bond yield hits new high.

Bitcoin, Ethereum, XRP and other altcoins pare gains ahead of Nvidia earnings, FOMC minutes, NFP jobs data.

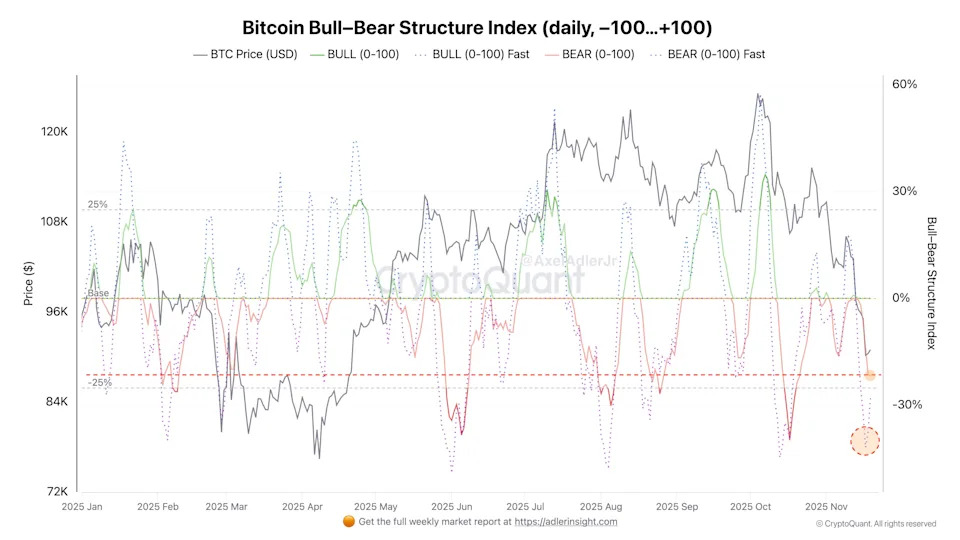

Bull-Bear Structure Index signals continued dominance of bearish factors.

Bitcoin, Ethereum, XRP and other altcoins pare gains as the crypto market braces for another potential selloff. New macro jitters are unlocking ahead of key events such as Nvidia earnings, FOMC minutes release, and Nonfarm payroll jobs data this week.

Japan’s long-term government bond yields surge to record highs f

Bitcoin, Ethereum, XRP and other altcoins pare gains ahead of Nvidia earnings, FOMC minutes, NFP jobs data.

Bull-Bear Structure Index signals continued dominance of bearish factors.

Bitcoin, Ethereum, XRP and other altcoins pare gains as the crypto market braces for another potential selloff. New macro jitters are unlocking ahead of key events such as Nvidia earnings, FOMC minutes release, and Nonfarm payroll jobs data this week.

Japan’s long-term government bond yields surge to record highs f

3 months ago

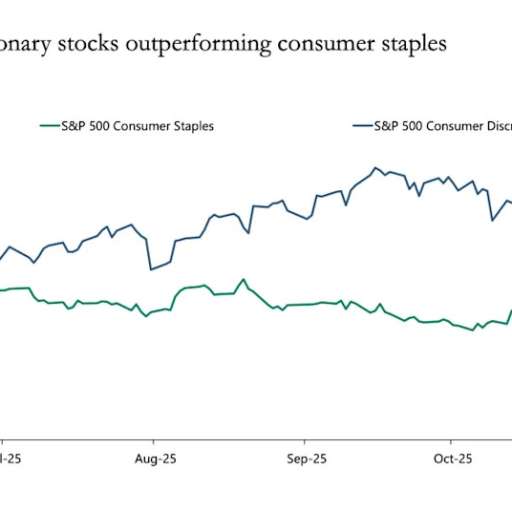

The narrative surrounding the “resilient U.S. consumer,” which has been a major upside surprise in 2025, is now facing significant headwinds, according to the Global Investment Committee (GIC) at Morgan Stanley Wealth Management. While consumer spending has maintained a steady nominal growth rate of 5% to 6%, underpinning a bullish outlook for US equities in 2026, the GIC is expressing caution.

Lisa Shalett, chief investment officer and head of the GIC, warned that although the broader macroeconomic picture remains cautiously optimistic, the “K-shaped” economy demands greater scrutiny. Specif

Lisa Shalett, chief investment officer and head of the GIC, warned that although the broader macroeconomic picture remains cautiously optimistic, the “K-shaped” economy demands greater scrutiny. Specif

8 months ago

9/ Market Correlation:

S&P 500 & BTC showed a -0.85 correlation during the news window

Stocks fall → Crypto falls — risk ***** ets under pressure

Traders: Stay nimble.

#Macro #CryptoStrategy

S&P 500 & BTC showed a -0.85 correlation during the news window

Stocks fall → Crypto falls — risk ***** ets under pressure

Traders: Stay nimble.

#Macro #CryptoStrategy

Sponsored by

Blue Mong

3 months ago