Administrator pinned this post

3 months ago

Get $10 for Every 100 Followers!

Don't miss out on this limited-time offer! For every 100 followers you gain, you'll receive $10.

Hurry, the campaign ends without prior notice! Be sure to take advantage before it’s too late.

For more details, check the banner.

Don't miss out on this limited-time offer! For every 100 followers you gain, you'll receive $10.

Hurry, the campaign ends without prior notice! Be sure to take advantage before it’s too late.

For more details, check the banner.

1 day ago

These are nervous times for Bitcoin (CRYPTO: BTC) investors. The world's most popular cryptocurrency is down a staggering 45% from its all-time high of $126,000 just a few months ago. It's now trading for just $70,000, and some think it might fall all the way to $50,000.

It's a stunning, epic collapse. But it's also nothing new for longtime Bitcoin investors. After every collapse, Bitcoin goes on to set a new all-time high. And that's what I think will happen this time as well. With that in mind, here are two ways to put $500 to work right now.

Will AI create the world's first trillionaire?

It's a stunning, epic collapse. But it's also nothing new for longtime Bitcoin investors. After every collapse, Bitcoin goes on to set a new all-time high. And that's what I think will happen this time as well. With that in mind, here are two ways to put $500 to work right now.

Will AI create the world's first trillionaire?

4 days ago

In recent days, BlackRock has been at the center of extreme crypto-market turbulence, as its iShares Bitcoin Trust (IBIT) and related options saw record trading activity amid theories of leveraged hedge fund blowups and institutional hedging feedback loops.

These events spotlight how a single, rapidly growing bitcoin ETF can influence broader digital-asset price moves and risk management behavior across the market.

We’ll now examine how the crypto-driven volatility around BlackRock’s IBIT ETF shapes the company’s investment narrative and perceived risk profile.

Capitalize on the AI infrastr

These events spotlight how a single, rapidly growing bitcoin ETF can influence broader digital-asset price moves and risk management behavior across the market.

We’ll now examine how the crypto-driven volatility around BlackRock’s IBIT ETF shapes the company’s investment narrative and perceived risk profile.

Capitalize on the AI infrastr

18 days ago

Bitcoin is trading near $88,600, up about 1.2% on the day, as markets absorb a fresh wave of institutional and regulatory developments that reinforce long-term conviction despite ongoing volatility.

With a market capitalization of $1.77 trillion and nearly 19.98 million BTC already in circulation, recent price action points to stabilization rather than stress following last week’s pullback from the $95,000 area.

Japan-based Bitcoin treasury firm Metaplanet raised its revenue and operating profit outlook for 2025 and 2026, even after booking a $680–$700 million non-cash Bitcoin impairment tie

With a market capitalization of $1.77 trillion and nearly 19.98 million BTC already in circulation, recent price action points to stabilization rather than stress following last week’s pullback from the $95,000 area.

Japan-based Bitcoin treasury firm Metaplanet raised its revenue and operating profit outlook for 2025 and 2026, even after booking a $680–$700 million non-cash Bitcoin impairment tie

19 days ago

Bitcoin is trading near $87,700, down about 1% on the day, yet Robert Kiyosaki remains unmoved by short-term price swings. The Rich Dad Poor Dad author says he continues buying Bitcoin and Ethereum regardless of volatility, arguing that price matters less than the direction of the global financial system.

In a recent post, Kiyosaki pointed to two forces shaping his strategy: the rising US national debt, now above $38.4 trillion, and the steady erosion of the dollar’s purchasing power. From his perspective, daily price movements are a distraction.

As debt expands and deficits deepen, scarce *

In a recent post, Kiyosaki pointed to two forces shaping his strategy: the rising US national debt, now above $38.4 trillion, and the steady erosion of the dollar’s purchasing power. From his perspective, daily price movements are a distraction.

As debt expands and deficits deepen, scarce *

19 days ago

Bitcoin is down just over 1% in the past 24 hours, but the bigger story is not the daily move. Over the weekend, the Bitcoin price came dangerously close to confirming a bearish breakdown before staging a short-term rebound.

A technical signal had been building for days, and on-chain data now shows that selling pressure is easing. Still, major risks remain. Whether Bitcoin stabilizes or slides toward $78,000 now depends on how the BTC price reacts at several key levels.

Bitcoin is still trading inside a head-and-shoulders pattern on the daily chart. This pattern often signals a bearish rever

A technical signal had been building for days, and on-chain data now shows that selling pressure is easing. Still, major risks remain. Whether Bitcoin stabilizes or slides toward $78,000 now depends on how the BTC price reacts at several key levels.

Bitcoin is still trading inside a head-and-shoulders pattern on the daily chart. This pattern often signals a bearish rever

19 days ago

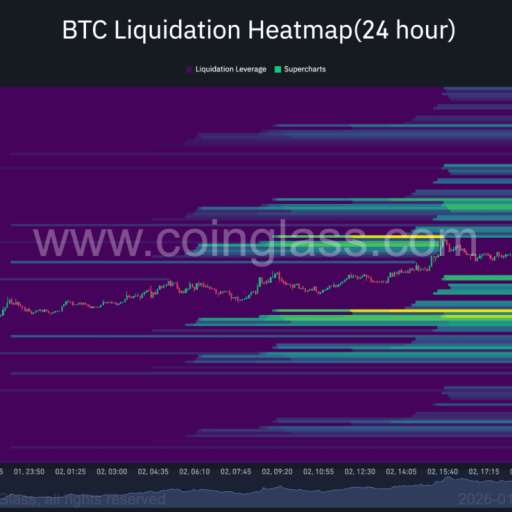

Bitcoin slipped below the $88,000 level on Sunday as crypto markets weakened in thin weekend trading, extending a pullback that has weighed on the crypto market over the past week.

BTC traded around $87,800 in U.S. afternoon hours, down roughly 2% over 24 hours, according to CoinDesk data. Ether fell toward $2,880, while solana, XRP and cardano each posted losses of between 3% and 5% on the day. Most major tokens have remained sharply down over the past seven days, reflecting the fragile sentiment across the market.

The move caused $224 million in liquidations on bullish bets in the last 24

BTC traded around $87,800 in U.S. afternoon hours, down roughly 2% over 24 hours, according to CoinDesk data. Ether fell toward $2,880, while solana, XRP and cardano each posted losses of between 3% and 5% on the day. Most major tokens have remained sharply down over the past seven days, reflecting the fragile sentiment across the market.

The move caused $224 million in liquidations on bullish bets in the last 24

20 days ago

Over the past week, the price of Bitcoin faced a significant setback in its goal of reclaiming the six-figure threshold....

The Bitcoin price had a relatively rough trading period over the past week, as it hovered around the psychological $90,000...

Bitcoin is trading below the $90,000 level once again, as the market continues to drift through a phase defined by...

https://www.newsbtc.com/ne...

The Bitcoin price had a relatively rough trading period over the past week, as it hovered around the psychological $90,000...

Bitcoin is trading below the $90,000 level once again, as the market continues to drift through a phase defined by...

https://www.newsbtc.com/ne...

20 days ago

US spot Bitcoin exchange-traded funds recorded their weakest performance in nearly a year, shedding $1.33 billion in net outflows during a shortened four-day trading week, according to data from SoSoValue.

Key Takeaways:

US spot Bitcoin ETFs logged their weakest week in nearly a year, with $1.33 billion in outflows.

Selling peaked midweek, led by heavy redemptions from BlackRock’s IBIT.

Ether ETFs also turned negative, shedding $611 million over the same period.

https://finance.yahoo.com/...

Key Takeaways:

US spot Bitcoin ETFs logged their weakest week in nearly a year, with $1.33 billion in outflows.

Selling peaked midweek, led by heavy redemptions from BlackRock’s IBIT.

Ether ETFs also turned negative, shedding $611 million over the same period.

https://finance.yahoo.com/...

20 days ago

Bitcoin ETFs Lose $1.72B in Five-Day Outflow Streak

The extended outflow streak comes as a widely used crypto sentiment indicator has stayed within the “Extreme Fear” range since Wednesday.

COINTELEGRAPH IN YOUR SOCIAL FEED

US-based spot Bitcoin exchange-traded funds (ETFs) have extended their outflow streak to five days as crypto market sentiment continues to wane.

Spot Bitcoin

BTC

$89,151

ETFs posted $103.5 million in net outflows on Friday, continuing an outflow streak that began the previous Friday.

Over the five days, including the four-day trading week in the US shortened by Ma

The extended outflow streak comes as a widely used crypto sentiment indicator has stayed within the “Extreme Fear” range since Wednesday.

COINTELEGRAPH IN YOUR SOCIAL FEED

US-based spot Bitcoin exchange-traded funds (ETFs) have extended their outflow streak to five days as crypto market sentiment continues to wane.

Spot Bitcoin

BTC

$89,151

ETFs posted $103.5 million in net outflows on Friday, continuing an outflow streak that began the previous Friday.

Over the five days, including the four-day trading week in the US shortened by Ma

20 days ago

The Bitcoin price had a relatively rough trading period over the past week, as it hovered around the psychological $90,000...

Reports say Swiss banking giant UBS is planning to let a small group of its private bank clients buy and...

Bitcoin is trading below the $90,000 level once again, as the market continues to drift through a phase defined by...

https://www.newsbtc.com/ne...

Reports say Swiss banking giant UBS is planning to let a small group of its private bank clients buy and...

Bitcoin is trading below the $90,000 level once again, as the market continues to drift through a phase defined by...

https://www.newsbtc.com/ne...

20 days ago

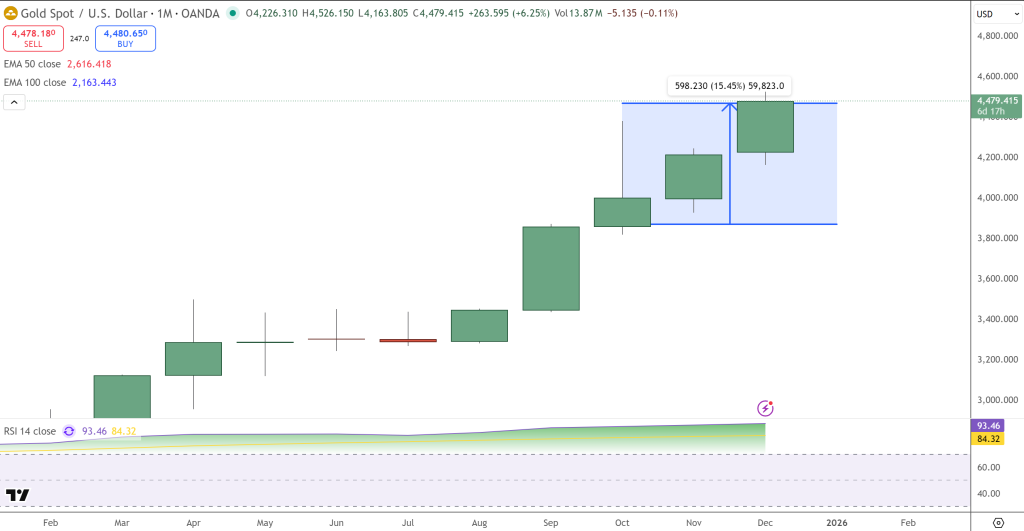

Why gold is the only go-to safe haven from global turmoil - not bitcoin or bonds

By Mark Hulbert

Investors don't have as much confidence in U.S. Treasurys as a risk hedge

Gold has become investors' go-to safe haven.

Among the ***** ets typically considered safe havens, gold (GC00) is the only one that rose in the wake of President Donald Trump's saber-rattling about Greenland. On Jan. 20, when the S&P 500 SPX fell 2.1%, long-term U.S. Treasurys BX:TMUBMUSD10Y - the traditional safe haven during times of geopolitical crisis - fell by more than they have in any other trading session since

By Mark Hulbert

Investors don't have as much confidence in U.S. Treasurys as a risk hedge

Gold has become investors' go-to safe haven.

Among the ***** ets typically considered safe havens, gold (GC00) is the only one that rose in the wake of President Donald Trump's saber-rattling about Greenland. On Jan. 20, when the S&P 500 SPX fell 2.1%, long-term U.S. Treasurys BX:TMUBMUSD10Y - the traditional safe haven during times of geopolitical crisis - fell by more than they have in any other trading session since

20 days ago

Bitcoin is trading near $89,500, locked in a tight range that reflects consolidation rather than weakness. While price action remains compressed, a series of institutional and regulatory developments this week is reshaping how the market views Bitcoin’s longer-term role.

South Korean authorities are investigating the disappearance of roughly 70 bn won ($48 mn) worth of seized Bitcoin from official custody. The issue surfaced during a routine audit by the Gwangju District Prosecutors’ Office, according to local reports.

Preliminary findings suggest the loss resulted from a phishing attack, af

South Korean authorities are investigating the disappearance of roughly 70 bn won ($48 mn) worth of seized Bitcoin from official custody. The issue surfaced during a routine audit by the Gwangju District Prosecutors’ Office, according to local reports.

Preliminary findings suggest the loss resulted from a phishing attack, af

20 days ago

XRP has given back all of its early‑year gains, sliding toward the $1.90. Despite the pullback, several on‑chain and market...

Bitcoin is trading below the $90,000 level once again, as the market continues to drift through a phase defined by...

XRP has begun attracting attention again after months of sideways trading. The coin has risen slightly over the past day,...

https://www.newsbtc.com/ne...

Bitcoin is trading below the $90,000 level once again, as the market continues to drift through a phase defined by...

XRP has begun attracting attention again after months of sideways trading. The coin has risen slightly over the past day,...

https://www.newsbtc.com/ne...

1 month ago

As 2025 came to a close, Bitcoin (BTC) ended on a negative note, trading more than 30% below its all-time...

Bitcoin closed the year slightly in the red, marking a rare break in the long-observed four-year cycle pattern of one...

A well-known finance coach in the XRP community has urged patience, calling the cryptocurrency’s price sliding under $2 a rare...

https://www.newsbtc.com/ne...

Bitcoin closed the year slightly in the red, marking a rare break in the long-observed four-year cycle pattern of one...

A well-known finance coach in the XRP community has urged patience, calling the cryptocurrency’s price sliding under $2 a rare...

https://www.newsbtc.com/ne...

1 month ago

Michael Saylor’s Bitcoin-focused company Strategy is once again edging toward a key valuation threshold, as its market-to-net-asset-value multiple, or mNAV, hovers just above levels that could undermine the logic of holding its stock as a proxy for Bitcoin exposure.

In early trading on January 2, Strategy shares rose modestly, offering brief relief after months of pressure.

Even with the bounce, the stock remains down roughly 66% from its July peak.

The company’s mNAV, a measure comparing its market valuation to the value of its Bitcoin holdings, stood near 1.02, leaving little margin befor

In early trading on January 2, Strategy shares rose modestly, offering brief relief after months of pressure.

Even with the bounce, the stock remains down roughly 66% from its July peak.

The company’s mNAV, a measure comparing its market valuation to the value of its Bitcoin holdings, stood near 1.02, leaving little margin befor

1 month ago

US stocks mostly edged higher on Friday as Wall Street kicked off trading in 2026 after its third consecutive year of double-digit percentage gains.

The Dow Jones Industrial Average (^DJI) gained about 0.6%, while the S&P 500 (^GSPC) increased 0.2%.

The tech-heavy Nasdaq Composite (^IXIC) fell below the flat line, despite gains in semiconductor giants Nvidia (NVDA), AMD (AMD), and Micron (MU).

Shares of Tesla (TSLA) fell after the EV maker's deliveries missed expectations.

Markets are coming off a sputtering end to a roller-coaster 2025 that nevertheless ended with sizable gains for the ma

The Dow Jones Industrial Average (^DJI) gained about 0.6%, while the S&P 500 (^GSPC) increased 0.2%.

The tech-heavy Nasdaq Composite (^IXIC) fell below the flat line, despite gains in semiconductor giants Nvidia (NVDA), AMD (AMD), and Micron (MU).

Shares of Tesla (TSLA) fell after the EV maker's deliveries missed expectations.

Markets are coming off a sputtering end to a roller-coaster 2025 that nevertheless ended with sizable gains for the ma

1 month ago

Bitcoin Reclaims $90K as U.S. Bid Returns

Bitcoin broke the psychological $90,000 barrier on Friday, trading at $90,742 (+3.2%) during the New York session, effectively snapping a Q4 2025 trend where U.S. trading hours were dominated by selling pressure.

The reversal reflects the end of end-of-year tax-loss harvesting that drove Bitcoin down 23% in Q4.

Buying volume accelerated at 09:30 ET, contrasting sharply with the “4 p.m. sell-off” pattern observed throughout December. CoinGlass data show futures open interest jumped 2.16% to $130 billion in the last 24 hours, indicating renewed leve

Bitcoin broke the psychological $90,000 barrier on Friday, trading at $90,742 (+3.2%) during the New York session, effectively snapping a Q4 2025 trend where U.S. trading hours were dominated by selling pressure.

The reversal reflects the end of end-of-year tax-loss harvesting that drove Bitcoin down 23% in Q4.

Buying volume accelerated at 09:30 ET, contrasting sharply with the “4 p.m. sell-off” pattern observed throughout December. CoinGlass data show futures open interest jumped 2.16% to $130 billion in the last 24 hours, indicating renewed leve

1 month ago

Bitcoin price attacks $90K as January dip buying sparks meme coin rally led by...

Bitcoin rose towards the upper bounds of its weekly trading range between $86,979.26 – $90,064 today, as subtle nods of risk-on sentiment returned across the market.

Investors have begun aggressively buying the dip to start the new year, shaking off the stagnation that characterised the final weeks of December.

Over the past 24 hours, the total crypto market cap regained its footing above the psychological $3 trillion mark, having rallied roughly 2% to $3.12 trillion at press time.

https://invezz.com/news

Bitcoin rose towards the upper bounds of its weekly trading range between $86,979.26 – $90,064 today, as subtle nods of risk-on sentiment returned across the market.

Investors have begun aggressively buying the dip to start the new year, shaking off the stagnation that characterised the final weeks of December.

Over the past 24 hours, the total crypto market cap regained its footing above the psychological $3 trillion mark, having rallied roughly 2% to $3.12 trillion at press time.

https://invezz.com/news

1 month ago

Institutional adoption continues to be the No. 1 factor pushing Bitcoin higher.

If both Wall Street and the White House continue with their pro-crypto initiatives, the price of Bitcoin is likely to rise.

A splashy new move, such as the adoption of Bitcoin by a major Silicon Valley tech company, could propel Bitcoin higher.

10 stocks we like better than Bitcoin ›

At the beginning of 2025, ***** ody could have predicted this: Bitcoin (CRYPTO: BTC) fell about 7% last year and is still trading well below the psychologically important $100,000 level.

https://finance.yahoo.com/...

If both Wall Street and the White House continue with their pro-crypto initiatives, the price of Bitcoin is likely to rise.

A splashy new move, such as the adoption of Bitcoin by a major Silicon Valley tech company, could propel Bitcoin higher.

10 stocks we like better than Bitcoin ›

At the beginning of 2025, ***** ody could have predicted this: Bitcoin (CRYPTO: BTC) fell about 7% last year and is still trading well below the psychologically important $100,000 level.

https://finance.yahoo.com/...

1 month ago

US stock futures rose early Friday as Wall Street kicked off trading in 2026 after its third consecutive year of double-digit percentage gains.

Dow Jones Industrial Average futures (YM=F) climbed 0.3%. Futures tied to the S&P 500 (ES=F) were up 0.6%, while those on the tech-heavy Nasdaq (NQ=F) gained 1%.

Nasdaq 100 futures gained following news out of Asia that lifted a regional tech gauge to an all-time high.

Markets are coming off a sputtering end to a roller-coaster 2025 that nevertheless ended with sizable gains for the major indexes. The benchmark S&P 500 (^GSPC) rose over 16%, while t

Dow Jones Industrial Average futures (YM=F) climbed 0.3%. Futures tied to the S&P 500 (ES=F) were up 0.6%, while those on the tech-heavy Nasdaq (NQ=F) gained 1%.

Nasdaq 100 futures gained following news out of Asia that lifted a regional tech gauge to an all-time high.

Markets are coming off a sputtering end to a roller-coaster 2025 that nevertheless ended with sizable gains for the major indexes. The benchmark S&P 500 (^GSPC) rose over 16%, while t

1 month ago

Bitcoin held near $88,000 on Friday as markets eased into the first trading session of 2026, with holiday-thinned volumes keeping moves measured and investors lining up for a year packed with policy and tech-driven catalysts.

Early risk-taking showed up most clearly in Asia, where Hong Kong and South Korea led gains as technology and semiconductor shares extended a late 2025 bounce. **** an and mainland China stayed shut for holidays, which kept liquidity light across the region.

Crypto traders kept a close eye on whether Bitcoin can turn that calm into momentum, after a choppy stretch aroun

Early risk-taking showed up most clearly in Asia, where Hong Kong and South Korea led gains as technology and semiconductor shares extended a late 2025 bounce. **** an and mainland China stayed shut for holidays, which kept liquidity light across the region.

Crypto traders kept a close eye on whether Bitcoin can turn that calm into momentum, after a choppy stretch aroun

1 month ago

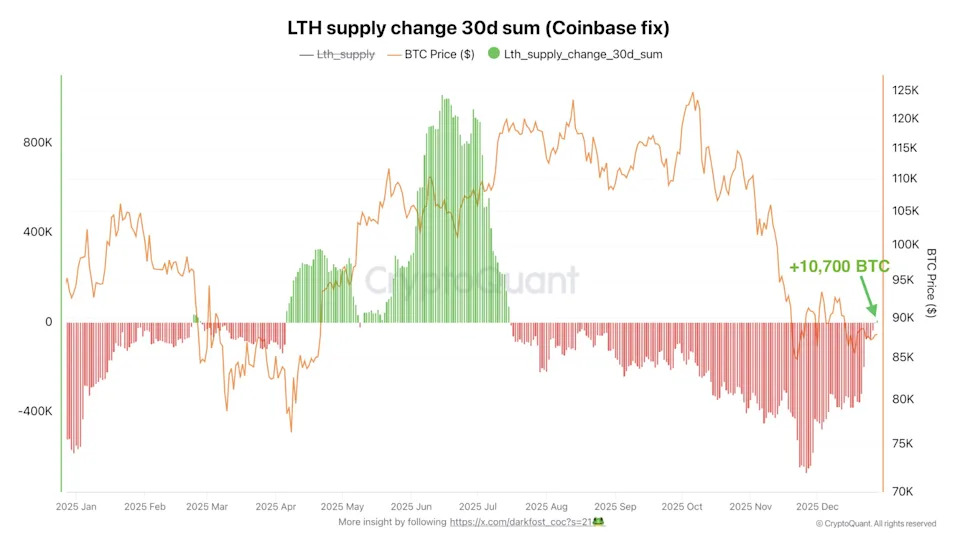

Bitcoin started 2026 stuck near $88,000, extending weeks of sideways trading. While price action looks stagnant, on-chain data suggests the market may be quietly shifting beneath the surface.

Three indicators from CryptoQuant point to easing sell pressure, even as macro uncertainty continues to cap upside momentum.

Bitcoin’s price has struggled to reclaim key resistance after a sharp pullback in late 2025. The lack of follow-through buying has kept sentiment fragile, with traders waiting for confirmation that the correction has run its course.

The first signal comes from long-term holder (L

Three indicators from CryptoQuant point to easing sell pressure, even as macro uncertainty continues to cap upside momentum.

Bitcoin’s price has struggled to reclaim key resistance after a sharp pullback in late 2025. The lack of follow-through buying has kept sentiment fragile, with traders waiting for confirmation that the correction has run its course.

The first signal comes from long-term holder (L

1 month ago

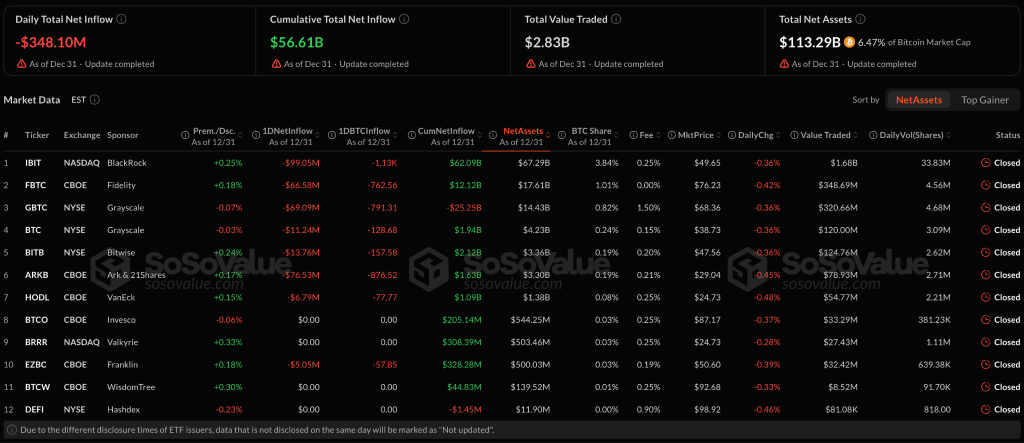

Bitcoin spot ETFs closed 2025’s final trading session with $348 million in net outflows across all 12 funds, while Bitcoin itself settled at $87,496, down 6% from its $93,381 year-end 2024 price.

The bearish year-end momentum extended across crypto investment products, with Ethereum ETFs recording $72.06 million in outflows and no inflows registered among the nine available funds.

However, Solana and XRP spot ETFs posted modest gains of $2.29 million and $5.58 million, respectively.

The dramatic close accompanied a $74.6 billion liquidity injection through the Federal Reserve’s Standing Rep

The bearish year-end momentum extended across crypto investment products, with Ethereum ETFs recording $72.06 million in outflows and no inflows registered among the nine available funds.

However, Solana and XRP spot ETFs posted modest gains of $2.29 million and $5.58 million, respectively.

The dramatic close accompanied a $74.6 billion liquidity injection through the Federal Reserve’s Standing Rep

1 month ago

Bitcoin spot ETFs closed 2025’s final trading session with $348 million in net outflows across all 12 funds, while Bitcoin itself settled at $87,496, down 6% from its $93,381 year-end 2024 price.

Source: SosoValue

The bearish year-end momentum extended across crypto investment products, with Ethereum ETFs recording $72.06 million in outflows and no inflows registered among the nine available funds.

However, Solana and XRP spot ETFs posted modest gains of $2.29 million and $5.58 million, respectively.

The dramatic close accompanied a $74.6 billion liquidity injection through the Federal Res

Source: SosoValue

The bearish year-end momentum extended across crypto investment products, with Ethereum ETFs recording $72.06 million in outflows and no inflows registered among the nine available funds.

However, Solana and XRP spot ETFs posted modest gains of $2.29 million and $5.58 million, respectively.

The dramatic close accompanied a $74.6 billion liquidity injection through the Federal Res

2 months ago

Bitcoin (BTC) has already been struggling to keep the $90,000 price mark afloat for the past few weeks and even dropped to $24,000 for a few seconds on Christmas Eve.

The screenshots of the price dip went viral on social media and sent a lot of crypto traders into a state of panic.

However, it wasn't a market-wide phenomenon.

In fact, what happened was that on Dec. 24, the BTC/USD1 trading pair on the world's largest crypto trading exchange, Binance, displayed the Bitcoin price of $24,111 for a few seconds before snapping back to the $87,000 level.

No other BTC trading pair displayed such

The screenshots of the price dip went viral on social media and sent a lot of crypto traders into a state of panic.

However, it wasn't a market-wide phenomenon.

In fact, what happened was that on Dec. 24, the BTC/USD1 trading pair on the world's largest crypto trading exchange, Binance, displayed the Bitcoin price of $24,111 for a few seconds before snapping back to the $87,000 level.

No other BTC trading pair displayed such

2 months ago

Key Takeaways

Bitcoin briefly plunged to $24,000 on Binance’s thinly traded BTC/USD1 pair during holiday trading.

A large market sell order wiped out limited buy-side liquidity, triggering a flash crash.

Arbitrage traders quickly corrected the price, while the broader Bitcoin market remained stable.

Bitcoin appeared to suffer a dramatic holiday “crash” on Dec. 24, when prices on one Binance trading pair briefly collapsed from around $87,000 to just over $24,000—sparking confusion, panic, and accusations of manipulation across social media.

https://finance.yahoo.com/...

Bitcoin briefly plunged to $24,000 on Binance’s thinly traded BTC/USD1 pair during holiday trading.

A large market sell order wiped out limited buy-side liquidity, triggering a flash crash.

Arbitrage traders quickly corrected the price, while the broader Bitcoin market remained stable.

Bitcoin appeared to suffer a dramatic holiday “crash” on Dec. 24, when prices on one Binance trading pair briefly collapsed from around $87,000 to just over $24,000—sparking confusion, panic, and accusations of manipulation across social media.

https://finance.yahoo.com/...

2 months ago

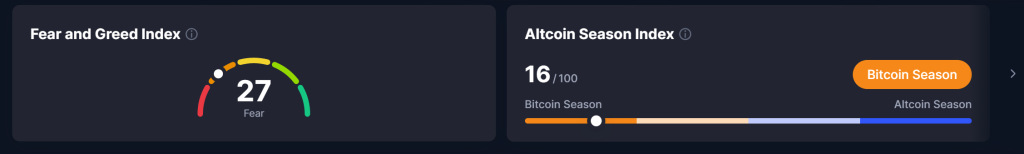

Bitcoin is hovering around $89,160 right now, having gained 1.5% in the last 24 hours. Daily trading volume is looking pretty strong at $24.3 billion and the world’s biggest cryptocurrency is still sitting pretty at top spot in market capitalisation, valued at roughly $1.78 trillion. There’s 19.97 million Bitcoin in circulation out of a total supply of 21 million.

Despite the bounce, overall market mood is still pretty cautious. The Crypto Fear and Greed Index is stuck at 27, firmly in ‘fear’ territory, and the Altcoin Season Index is down to 16, which means Bitcoin Season is well and truly i

Despite the bounce, overall market mood is still pretty cautious. The Crypto Fear and Greed Index is stuck at 27, firmly in ‘fear’ territory, and the Altcoin Season Index is down to 16, which means Bitcoin Season is well and truly i

2 months ago

Bitcoin (BTC) traders are watching a familiar sentiment signal after CNBC host Jim Cramer’s latest public comments skewed sharply negative on BTC, a shift that some in crypto circles treat as a contrarian cue.

Third-party tracker Unbias, which logs Cramer’s Bitcoin-related posts, shows his recent calls leaning bearish. But the trading community thinks this could be a good thing for bitcoin.

Unbias’ dashboard categorizes several of Cramer’s most recent BTC entries as bearish or “bearish (nuanced),” indicating a permanently bearish stance on the leading cryptocurrency across his latest batch o

Third-party tracker Unbias, which logs Cramer’s Bitcoin-related posts, shows his recent calls leaning bearish. But the trading community thinks this could be a good thing for bitcoin.

Unbias’ dashboard categorizes several of Cramer’s most recent BTC entries as bearish or “bearish (nuanced),” indicating a permanently bearish stance on the leading cryptocurrency across his latest batch o

2 months ago

By checking the past five years of bitcoin (BTC) CME futures trading data, it is possible to ***** s where that crypto has historically spent time consolidating and, by extension, where support has been more or less established.

One useful way to frame this is by examining the number of trading days bitcoin has spent within specific price bands. The more time price has spent in a given range, the more opportunity there has been for positions to be built, which can later translate into stronger support.

Data from Investing.com shows clear disparities across price ranges. Excluding the very br

One useful way to frame this is by examining the number of trading days bitcoin has spent within specific price bands. The more time price has spent in a given range, the more opportunity there has been for positions to be built, which can later translate into stronger support.

Data from Investing.com shows clear disparities across price ranges. Excluding the very br

2 months ago

Bitcoin is trading near $87,400, up roughly 0.8% on the day, as investors reassess risk exposure amid a powerful rally in precious metals. With a market capitalization of $1.74 tn and daily trading volume near $21.7 bn, Bitcoin remains firmly positioned as the market’s dominant digital ******* et. While price has pulled back from December’s $94,600 high, the current pause looks more like consolidation than weakness.

Markets appear increasingly sensitive to signals of ******* et debasement and rising global debt levels. That narrative has helped sustain demand for hard ******* ets and, by exte

Markets appear increasingly sensitive to signals of ******* et debasement and rising global debt levels. That narrative has helped sustain demand for hard ******* ets and, by exte

Sponsored by

Blue Mong

3 months ago