Administrator pinned this post

3 months ago

Get $10 for Every 100 Followers!

Don't miss out on this limited-time offer! For every 100 followers you gain, you'll receive $10.

Hurry, the campaign ends without prior notice! Be sure to take advantage before it’s too late.

For more details, check the banner.

Don't miss out on this limited-time offer! For every 100 followers you gain, you'll receive $10.

Hurry, the campaign ends without prior notice! Be sure to take advantage before it’s too late.

For more details, check the banner.

4 days ago

Stocks climb while warnings grow over what's next

The Dow Jones Industrial Average hit a fresh record high on Monday, after topping 50,000 for the first time last week. The S&P 500 and teach-heavy Nasdaq also climbed, continuing to reverse major losses suffered days earlier.

The performance marked the latest move in topsy-turvy markets -- and that rollercoaster may very well continue, some **** ysts told ABC News.

Analysts attributed the volatility to a flurry of developments in artificial intelligence (AI), and a perception of looming geopolitical uncertainty. Mixed signals in economic d

The Dow Jones Industrial Average hit a fresh record high on Monday, after topping 50,000 for the first time last week. The S&P 500 and teach-heavy Nasdaq also climbed, continuing to reverse major losses suffered days earlier.

The performance marked the latest move in topsy-turvy markets -- and that rollercoaster may very well continue, some **** ysts told ABC News.

Analysts attributed the volatility to a flurry of developments in artificial intelligence (AI), and a perception of looming geopolitical uncertainty. Mixed signals in economic d

18 days ago

Bitcoin is trading near $88,600, up about 1.2% on the day, as markets absorb a fresh wave of institutional and regulatory developments that reinforce long-term conviction despite ongoing volatility.

With a market capitalization of $1.77 trillion and nearly 19.98 million BTC already in circulation, recent price action points to stabilization rather than stress following last week’s pullback from the $95,000 area.

Japan-based Bitcoin treasury firm Metaplanet raised its revenue and operating profit outlook for 2025 and 2026, even after booking a $680–$700 million non-cash Bitcoin impairment tie

With a market capitalization of $1.77 trillion and nearly 19.98 million BTC already in circulation, recent price action points to stabilization rather than stress following last week’s pullback from the $95,000 area.

Japan-based Bitcoin treasury firm Metaplanet raised its revenue and operating profit outlook for 2025 and 2026, even after booking a $680–$700 million non-cash Bitcoin impairment tie

18 days ago

KALIDA — Unverferth Manufacturing Company has announced that its Air Command Section Control System, designed for Unverferth Pro-Force dry fertilizer spreaders, has received the prestigious AE50 Award.

This award recognizes the year’s most innovative products in agriculture, food and biological systems, honoring advancements that demonstrate exceptional engineering achievement and meaningful impact in the markets they serve.

Unverferth’s Air Command Section Control technology was selected as one of approximately 50 award recipients for its ability to enhance application accuracy and help pro

This award recognizes the year’s most innovative products in agriculture, food and biological systems, honoring advancements that demonstrate exceptional engineering achievement and meaningful impact in the markets they serve.

Unverferth’s Air Command Section Control technology was selected as one of approximately 50 award recipients for its ability to enhance application accuracy and help pro

18 days ago

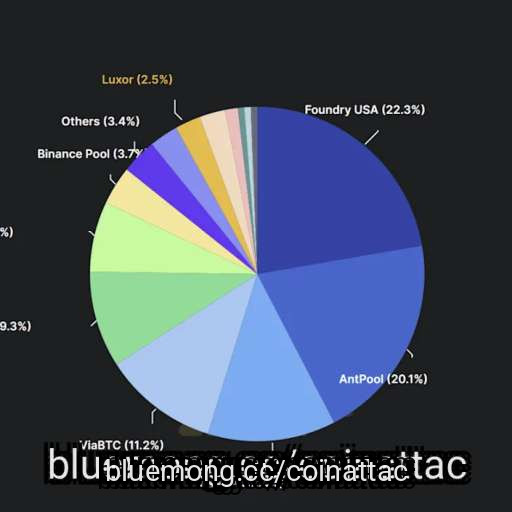

Bitcoin’s network hit an unusual speed **** p over the weekend, not because of code, markets or a Fed policy change, but because the physical world intervened.

A sprawling winter storm strained regional power grids and knocked out electricity for hundreds of thousands of households.

The disruption briefly spilled into crypto infrastructure, as some US-based Bitcoin miners cut power use and the network’s block production slowed, without sparking market panic.

Related: U.S. Government Targets Russia’s Crypto Mining Industry for Sanctions Amid Ukraine War

Winter Storm Fern swept across a wide

A sprawling winter storm strained regional power grids and knocked out electricity for hundreds of thousands of households.

The disruption briefly spilled into crypto infrastructure, as some US-based Bitcoin miners cut power use and the network’s block production slowed, without sparking market panic.

Related: U.S. Government Targets Russia’s Crypto Mining Industry for Sanctions Amid Ukraine War

Winter Storm Fern swept across a wide

19 days ago

I’ve been covering crypto markets for long enough to remember when Ark Invest CEO Cathie Wood’s interest in Bitcoin (BTC) was treated with backlash.

In a 2018 note published on ARK Invest (written by Cathie Wood), she said ARK was the first public ****** et manager to gain Bitcoin exposure (via Grayscale’s Bitcoin Investment Trust/GBTC) and that the move prompted “a number of questions and much ridicule” in September 2015.

The skepticism wasn’t necessarily a huge personal attack, but professionals at the time often questioned the seriousness of crypto as an investable ****** et and viewed su

In a 2018 note published on ARK Invest (written by Cathie Wood), she said ARK was the first public ****** et manager to gain Bitcoin exposure (via Grayscale’s Bitcoin Investment Trust/GBTC) and that the move prompted “a number of questions and much ridicule” in September 2015.

The skepticism wasn’t necessarily a huge personal attack, but professionals at the time often questioned the seriousness of crypto as an investable ****** et and viewed su

19 days ago

Bitcoin slipped below the $88,000 level on Sunday as crypto markets weakened in thin weekend trading, extending a pullback that has weighed on the crypto market over the past week.

BTC traded around $87,800 in U.S. afternoon hours, down roughly 2% over 24 hours, according to CoinDesk data. Ether fell toward $2,880, while solana, XRP and cardano each posted losses of between 3% and 5% on the day. Most major tokens have remained sharply down over the past seven days, reflecting the fragile sentiment across the market.

The move caused $224 million in liquidations on bullish bets in the last 24

BTC traded around $87,800 in U.S. afternoon hours, down roughly 2% over 24 hours, according to CoinDesk data. Ether fell toward $2,880, while solana, XRP and cardano each posted losses of between 3% and 5% on the day. Most major tokens have remained sharply down over the past seven days, reflecting the fragile sentiment across the market.

The move caused $224 million in liquidations on bullish bets in the last 24

1 month ago

As 2025 came to a close, subtle changes in Federal Reserve activity started to catch the attention of traders watching both macro markets and crypto. Unusual moves in short-term funding and a series of quiet policy adjustments suggested that liquidity pressures might be easing. For some observers, that raised the possibility that Bitcoin could start moving higher before traditional markets show clearer signs of recovery in 2026.

On December 31, 2025, banks drew a record $74.6 billion from the Federal Reserve’s Standing Repo Facility. That spike pointed to stress in short-term funding markets

On December 31, 2025, banks drew a record $74.6 billion from the Federal Reserve’s Standing Repo Facility. That spike pointed to stress in short-term funding markets

1 month ago

US stocks mostly edged higher on Friday as Wall Street kicked off trading in 2026 after its third consecutive year of double-digit percentage gains.

The Dow Jones Industrial Average (^DJI) gained about 0.6%, while the S&P 500 (^GSPC) increased 0.2%.

The tech-heavy Nasdaq Composite (^IXIC) fell below the flat line, despite gains in semiconductor giants Nvidia (NVDA), AMD (AMD), and Micron (MU).

Shares of Tesla (TSLA) fell after the EV maker's deliveries missed expectations.

Markets are coming off a sputtering end to a roller-coaster 2025 that nevertheless ended with sizable gains for the ma

The Dow Jones Industrial Average (^DJI) gained about 0.6%, while the S&P 500 (^GSPC) increased 0.2%.

The tech-heavy Nasdaq Composite (^IXIC) fell below the flat line, despite gains in semiconductor giants Nvidia (NVDA), AMD (AMD), and Micron (MU).

Shares of Tesla (TSLA) fell after the EV maker's deliveries missed expectations.

Markets are coming off a sputtering end to a roller-coaster 2025 that nevertheless ended with sizable gains for the ma

1 month ago

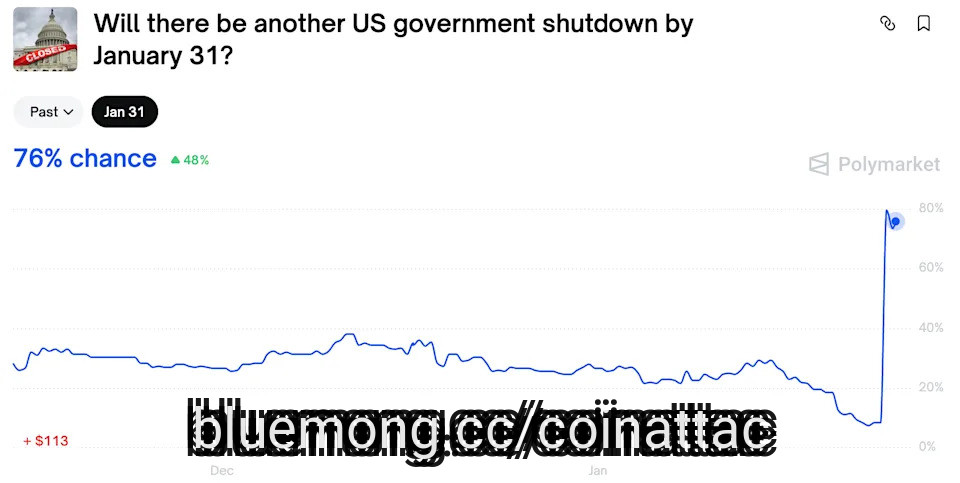

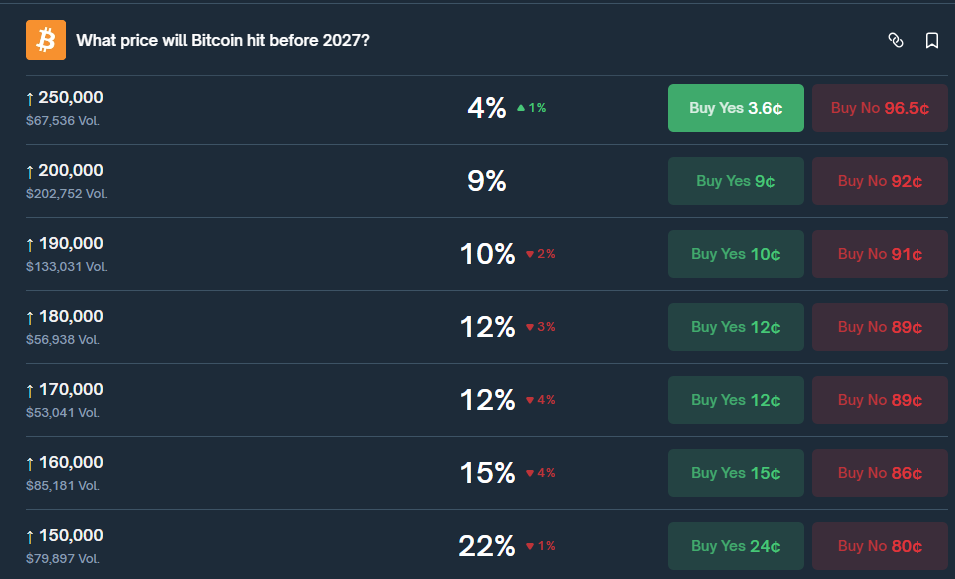

Bitcoin is entering 2026 at a decisive moment. Price action is compressing, RSI is turning higher, and institutional buyers continue to accumulate, yet prediction markets remain skeptical of a rapid six-figure breakout.

Polymarket odds still favor $120,000 as the most likely outcome, even as Bitcoin trades within a tightening triangle near $89,000. The next move could set the tone for the year ahead.

Bitcoin is kickstarting 2026 with a mixed bag of optimism and realism. While ****** ysts are still tossing around six-figure targets, Polymarket traders are still being cautious about how high t

Polymarket odds still favor $120,000 as the most likely outcome, even as Bitcoin trades within a tightening triangle near $89,000. The next move could set the tone for the year ahead.

Bitcoin is kickstarting 2026 with a mixed bag of optimism and realism. While ****** ysts are still tossing around six-figure targets, Polymarket traders are still being cautious about how high t

1 month ago

US stock futures rose early Friday as Wall Street kicked off trading in 2026 after its third consecutive year of double-digit percentage gains.

Dow Jones Industrial Average futures (YM=F) climbed 0.3%. Futures tied to the S&P 500 (ES=F) were up 0.6%, while those on the tech-heavy Nasdaq (NQ=F) gained 1%.

Nasdaq 100 futures gained following news out of Asia that lifted a regional tech gauge to an all-time high.

Markets are coming off a sputtering end to a roller-coaster 2025 that nevertheless ended with sizable gains for the major indexes. The benchmark S&P 500 (^GSPC) rose over 16%, while t

Dow Jones Industrial Average futures (YM=F) climbed 0.3%. Futures tied to the S&P 500 (ES=F) were up 0.6%, while those on the tech-heavy Nasdaq (NQ=F) gained 1%.

Nasdaq 100 futures gained following news out of Asia that lifted a regional tech gauge to an all-time high.

Markets are coming off a sputtering end to a roller-coaster 2025 that nevertheless ended with sizable gains for the major indexes. The benchmark S&P 500 (^GSPC) rose over 16%, while t

1 month ago

Bitcoin held near $88,000 on Friday as markets eased into the first trading session of 2026, with holiday-thinned volumes keeping moves measured and investors lining up for a year packed with policy and tech-driven catalysts.

Early risk-taking showed up most clearly in Asia, where Hong Kong and South Korea led gains as technology and semiconductor shares extended a late 2025 bounce. **** an and mainland China stayed shut for holidays, which kept liquidity light across the region.

Crypto traders kept a close eye on whether Bitcoin can turn that calm into momentum, after a choppy stretch aroun

Early risk-taking showed up most clearly in Asia, where Hong Kong and South Korea led gains as technology and semiconductor shares extended a late 2025 bounce. **** an and mainland China stayed shut for holidays, which kept liquidity light across the region.

Crypto traders kept a close eye on whether Bitcoin can turn that calm into momentum, after a choppy stretch aroun

2 months ago

As interest in Bitcoin continues to rise and fall with the markets, a new study from SmartAsset offers one of the clearest snapshots yet of where Americans are actually participating in crypto. The findings reveal that enthusiasm isn’t spread evenly across the country. Some states have developed strong pockets of adoption driven by tech culture, higher incomes and a comfort with digital innovation, while others remain slow to engage.

These regional differences don’t just show where Bitcoin has the most momentum. They also help frame the broader conversation around who’s driving crypto adoptio

These regional differences don’t just show where Bitcoin has the most momentum. They also help frame the broader conversation around who’s driving crypto adoptio

2 months ago

Quantum computing remains a concern for Bitcoin and crypto markets, posing a security threat to its underlying cryptography. However, a new threat emerges as a controversial "Cat" Bitcoin Improvement Proposal, sparking heated debate among developers about labeling millions of inscription-related outputs as permanently unspendable.

The draft BIP seeks to address concerns about blockchain bloat, raising key questions around property rights and core Bitcoin principles. Community responses range from strong support to warnings about setting a risky precedent.

Every Bitcoin transaction spends coi

The draft BIP seeks to address concerns about blockchain bloat, raising key questions around property rights and core Bitcoin principles. Community responses range from strong support to warnings about setting a risky precedent.

Every Bitcoin transaction spends coi

2 months ago

Bitcoin held near $89,127 in thin Boxing Day trade as Asian stocks edged higher and silver stayed in the spotlight after notching fresh record highs this week, with investors still leaning into the year-end risk bid.

With several Asia Pacific exchanges shut for the holiday, investors took cues from the last full session, when MSCI’s broadest index of Asia Pacific shares outside ***** an rose 0.35%.

Crypto traders framed the quieter tape as a liquidity story as much as a macro one. Gabriel Selby, head of research at CF Benchmarks, said Bitcoin remained pinned under a key level as markets drif

With several Asia Pacific exchanges shut for the holiday, investors took cues from the last full session, when MSCI’s broadest index of Asia Pacific shares outside ***** an rose 0.35%.

Crypto traders framed the quieter tape as a liquidity story as much as a macro one. Gabriel Selby, head of research at CF Benchmarks, said Bitcoin remained pinned under a key level as markets drif

2 months ago

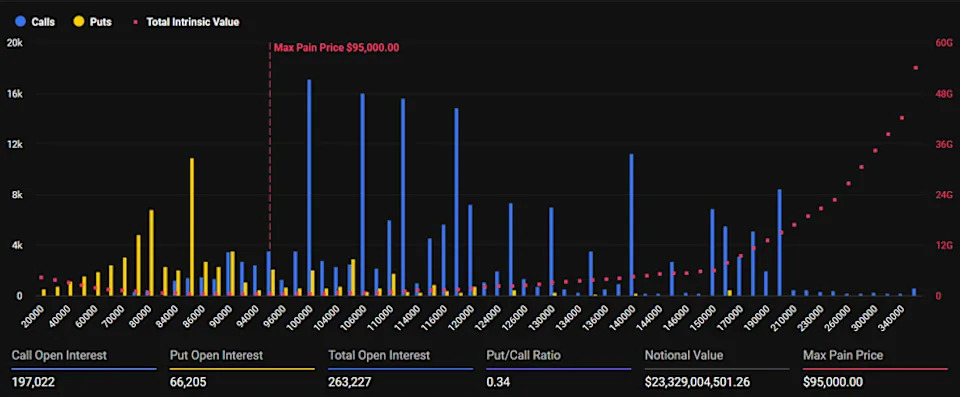

Crypto markets are bracing for a historic year-end event today, December 26, with more than $27 billion in Bitcoin and Ethereum options expiring on Deribit. This represents over half of the derivatives exchange’s total open interest.

The colossal “Boxing Day” expiry could mark one of the largest structural resets in crypto history.

Today’s options expiry is significantly higher than those witnessed last week, given it is the last Friday of the month and the year. More precisely, today’s expiring options are for the month and for the quarter (Q4 2025).

The numbers are staggering, with Bitcoi

The colossal “Boxing Day” expiry could mark one of the largest structural resets in crypto history.

Today’s options expiry is significantly higher than those witnessed last week, given it is the last Friday of the month and the year. More precisely, today’s expiring options are for the month and for the quarter (Q4 2025).

The numbers are staggering, with Bitcoi

2 months ago

Bitcoin held near $89,127 in thin Boxing Day trade as Asian stocks edged higher and silver stayed in the spotlight after notching fresh record highs this week, with investors still leaning into the year-end risk bid.

With several Asia Pacific exchanges shut for the holiday, investors took cues from the last full session, when MSCI’s broadest index of Asia Pacific shares outside **** an rose 0.35%.

Crypto traders framed the quieter tape as a liquidity story as much as a macro one. Gabriel Selby, head of research at CF Benchmarks, said Bitcoin remained pinned under a key level as markets drift

With several Asia Pacific exchanges shut for the holiday, investors took cues from the last full session, when MSCI’s broadest index of Asia Pacific shares outside **** an rose 0.35%.

Crypto traders framed the quieter tape as a liquidity story as much as a macro one. Gabriel Selby, head of research at CF Benchmarks, said Bitcoin remained pinned under a key level as markets drift

2 months ago

2025 has been a largely strong year for the cryptocurrency market.

Bitcoin climbed to a new all-time high of $126,000 during the year, alongside the launch of several new altcoin-focused exchange-traded funds and the establishment of a Bitcoin Strategic Reserve in the United States.

The period was also marked by continued accumulation of Bitcoin by corporate treasury holders such as Strategy, as well as a series of broader macroeconomic developments that influenced digital ******* et markets.

https://invezz.com/news/20...

Bitcoin climbed to a new all-time high of $126,000 during the year, alongside the launch of several new altcoin-focused exchange-traded funds and the establishment of a Bitcoin Strategic Reserve in the United States.

The period was also marked by continued accumulation of Bitcoin by corporate treasury holders such as Strategy, as well as a series of broader macroeconomic developments that influenced digital ******* et markets.

https://invezz.com/news/20...

2 months ago

Silver markets sent a clear signal on Christmas Day. While Bitcoin traded quietly in thin holiday liquidity, silver prices in China surged to record local levels, driven by tight physical supply and strong industrial demand.

The divergence highlights a growing macro theme. During periods of scarcity and geopolitical stress, capital is flowing toward hard ***** ets rather than digital alternatives.

The latest silver move originated in China, where local prices reached record levels on December 25. Evidently, China is facing a shortage of physical silver.

Globally, spot silver hovered near re

The divergence highlights a growing macro theme. During periods of scarcity and geopolitical stress, capital is flowing toward hard ***** ets rather than digital alternatives.

The latest silver move originated in China, where local prices reached record levels on December 25. Evidently, China is facing a shortage of physical silver.

Globally, spot silver hovered near re

2 months ago

Bitcoin is trading near $87,400, up roughly 0.8% on the day, as investors reassess risk exposure amid a powerful rally in precious metals. With a market capitalization of $1.74 tn and daily trading volume near $21.7 bn, Bitcoin remains firmly positioned as the market’s dominant digital ******* et. While price has pulled back from December’s $94,600 high, the current pause looks more like consolidation than weakness.

Markets appear increasingly sensitive to signals of ******* et debasement and rising global debt levels. That narrative has helped sustain demand for hard ******* ets and, by exte

Markets appear increasingly sensitive to signals of ******* et debasement and rising global debt levels. That narrative has helped sustain demand for hard ******* ets and, by exte

2 months ago

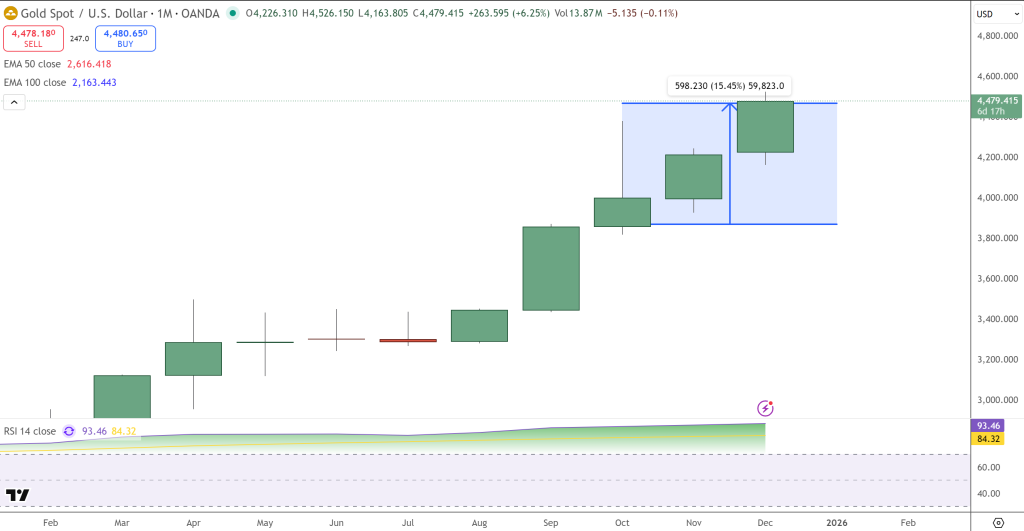

Bitcoin price action has remained mixed in recent sessions, reflecting uncertainty across global markets. At the time of writing, broader risk cues offer little direction for short-term momentum.

However, one notable signal is emerging from gold, whose recent strength may be positioning Bitcoin for a renewed rally if historical correlations continue to hold.

Bitcoin has increasingly mirrored gold’s trajectory over the past year, reinforcing its role as a macro-sensitive ****** et. Historically, sharp advances in gold prices have often preceded upside moves in Bitcoin. This relationship stems

However, one notable signal is emerging from gold, whose recent strength may be positioning Bitcoin for a renewed rally if historical correlations continue to hold.

Bitcoin has increasingly mirrored gold’s trajectory over the past year, reinforcing its role as a macro-sensitive ****** et. Historically, sharp advances in gold prices have often preceded upside moves in Bitcoin. This relationship stems

2 months ago

(Bloomberg) -- Bitcoin is missing out on the Christmas cheer.

As traditional markets move into the final days of the year with a burst of seasonal optimism, the world’s largest cryptocurrency has barely stirred. Bitcoin is trading around $87,370, pinned in a $85,000 to $90,000 range and showing little sign of life — an ****** et built on hype, volatility and disruption ending the year in a standstill.

Most Read from Bloomberg

New York's Congestion Pricing Is Working. Five Charts Show How

As Zipcar Leaves London, Car-Share Boosters Are Looking for a New Ride

https://finance.yahoo.com/...

As traditional markets move into the final days of the year with a burst of seasonal optimism, the world’s largest cryptocurrency has barely stirred. Bitcoin is trading around $87,370, pinned in a $85,000 to $90,000 range and showing little sign of life — an ****** et built on hype, volatility and disruption ending the year in a standstill.

Most Read from Bloomberg

New York's Congestion Pricing Is Working. Five Charts Show How

As Zipcar Leaves London, Car-Share Boosters Are Looking for a New Ride

https://finance.yahoo.com/...

2 months ago

Bitcoin dominance continues its relentless climb as markets consolidate into year-end, leaving altcoins trapped under heavy supply pressure and an unforgiving token unlock schedule.

Wintermute’s latest market update confirms what many traders feared. Retail investors are rotating out of altcoins and back into major **** ets, signaling the end of the anticipated altcoin rally that typically follows Bitcoin’s strong performance.

The broader crypto market extended losses over the past 24 hours, with Bitcoin slipping 1.12% below $87,000 and Ethereum dropping 1.5% near $3,000.

Several altcoins s

Wintermute’s latest market update confirms what many traders feared. Retail investors are rotating out of altcoins and back into major **** ets, signaling the end of the anticipated altcoin rally that typically follows Bitcoin’s strong performance.

The broader crypto market extended losses over the past 24 hours, with Bitcoin slipping 1.12% below $87,000 and Ethereum dropping 1.5% near $3,000.

Several altcoins s

2 months ago

Bitcoin is trading near $87,550, down roughly 2.6% over the past 24 hours, as short-term sentiment cools across crypto markets. Despite the pullback, the broader structure suggests consolidation rather than collapse. Bitcoin remains the largest digital ***** et by market value, with a capitalization of $1.74 tn, while daily trading volume holds above $42 bn, signaling continued institutional and retail participation.

Market-wide indicators reinforce the cautious tone. The Crypto Fear and Greed Index sits at 29, firmly in “fear” territory, while the Altcoin Season Index reads just 17, undersco

Market-wide indicators reinforce the cautious tone. The Crypto Fear and Greed Index sits at 29, firmly in “fear” territory, while the Altcoin Season Index reads just 17, undersco

2 months ago

Key Takeaways

Leaked Fundstrat guidance warns of a sharp early-2026 crypto correction, contrasting Tom Lee’s Bitcoin and Ethereum predictions.

Fundstrat denies internal disagreement.

Tom Lee remains publicly bullish on Bitcoin and Ethereum.

A leaked document circulating on social media and attributed to Fundstrat Global Advisors warns of a sharp correction in cryptocurrency markets in early 2026, setting price targets for Bitcoin and Ethereum that sharply contrast with the public bullish forecasts of the firm’s chairman, Tom Lee.

https://finance.yahoo.com/...

Leaked Fundstrat guidance warns of a sharp early-2026 crypto correction, contrasting Tom Lee’s Bitcoin and Ethereum predictions.

Fundstrat denies internal disagreement.

Tom Lee remains publicly bullish on Bitcoin and Ethereum.

A leaked document circulating on social media and attributed to Fundstrat Global Advisors warns of a sharp correction in cryptocurrency markets in early 2026, setting price targets for Bitcoin and Ethereum that sharply contrast with the public bullish forecasts of the firm’s chairman, Tom Lee.

https://finance.yahoo.com/...

2 months ago

The recent Bitcoin price decline has already triggered a major sell-off wave across the crypto market, and it doesn’t seem...

Fidelity’s top markets strategist has warned that Bitcoin’s October high of $126,000 could mark the top of the current cycle,...

灰度(Grayscale)在 12 月中旬發布《2026 Digital **** et Outlook》,丟出一個很「不討喜但很可能正確」的觀點:加密市場未必還會照著大家熟悉的比特幣「四年週期」劇本走。...

https://www.newsbtc.com/ne...

Fidelity’s top markets strategist has warned that Bitcoin’s October high of $126,000 could mark the top of the current cycle,...

灰度(Grayscale)在 12 月中旬發布《2026 Digital **** et Outlook》,丟出一個很「不討喜但很可能正確」的觀點:加密市場未必還會照著大家熟悉的比特幣「四年週期」劇本走。...

https://www.newsbtc.com/ne...

2 months ago

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Bitcoin (CRYPTO: BTC) is consolidating below $90,000, but BitMEX co-founder Arthur Hayes says the pause masks a powerful liquidity-driven move that could send the cryptocurrency to $200,000 in 2026.

What Happened: In his latest essay, "Love Language," Hayes argues the Federal Reserve's newly introduced "Reserve Management Purchases" (RMP) program is effectively a rebranded form of Quantitative Easing (QE).

He says the change in terminology is designed to avoid alarming markets with overt ref

Bitcoin (CRYPTO: BTC) is consolidating below $90,000, but BitMEX co-founder Arthur Hayes says the pause masks a powerful liquidity-driven move that could send the cryptocurrency to $200,000 in 2026.

What Happened: In his latest essay, "Love Language," Hayes argues the Federal Reserve's newly introduced "Reserve Management Purchases" (RMP) program is effectively a rebranded form of Quantitative Easing (QE).

He says the change in terminology is designed to avoid alarming markets with overt ref

2 months ago

Fresh US economic data is sending a clear but nuanced signal to markets. Inflation pressures are easing, but consumers remain under strain.

For Bitcoin and the broader crypto market, that mix points to improving macro conditions, tempered by near-term volatility.

US consumer sentiment edged up to 52.9 in December, slightly higher than November but still nearly 30% lower than a year ago, according to the University of Michigan.

At the same time, inflation expectations continued to fall. Short-term expectations dropped to 4.2%, while long-term expectations eased to 3.2%.

For markets, those i

For Bitcoin and the broader crypto market, that mix points to improving macro conditions, tempered by near-term volatility.

US consumer sentiment edged up to 52.9 in December, slightly higher than November but still nearly 30% lower than a year ago, according to the University of Michigan.

At the same time, inflation expectations continued to fall. Short-term expectations dropped to 4.2%, while long-term expectations eased to 3.2%.

For markets, those i

2 months ago

Professor Andrew Urquhart is Professor of Finance and Financial Technology and Head of the Department of Finance at Birmingham Business School (BBS).

This is the tenth installment of the Professor Coin column, in which I bring important insights from published academic literature on cryptocurrencies to the Decrypt readership. In this article, I discuss how crypto’s relationship with equities has evolved.

Not so long ago, Bitcoin was marketed as the ultimate diversifier—an ***** et supposedly immune to whatever was happening in equity markets. Early academic work backed that up: Liu and Tsyvi

This is the tenth installment of the Professor Coin column, in which I bring important insights from published academic literature on cryptocurrencies to the Decrypt readership. In this article, I discuss how crypto’s relationship with equities has evolved.

Not so long ago, Bitcoin was marketed as the ultimate diversifier—an ***** et supposedly immune to whatever was happening in equity markets. Early academic work backed that up: Liu and Tsyvi

2 months ago

Bitcoin may be holding slightly below $90,000, but data imply that the $100K year-end target is still alive as ****** ysts point out that three Bitcoin Price Prediction indicators are flashing a green signal.

The first and most critical driver is the shift in Federal Reserve monetary policy.

After months of reducing liquidity through quantitative tightening, where the central bank stopped reinvesting proceeds from maturing bonds and Treasury holdings, the Fed ended this program on December 1.

Markets are now positioning for an easing cycle.

https://cryptonews.com/new...

The first and most critical driver is the shift in Federal Reserve monetary policy.

After months of reducing liquidity through quantitative tightening, where the central bank stopped reinvesting proceeds from maturing bonds and Treasury holdings, the Fed ended this program on December 1.

Markets are now positioning for an easing cycle.

https://cryptonews.com/new...

2 months ago

Crypto is down again, and the drop is chewing our portfolios as we see the rise in crypto liquidations and debate on Michael Burry and his Bitcoin comments. With crypto down across major ******* ets and liquidations climbing, we are questioning why Bitcoin is falling even while traditional markets are up.

What deepens the discussion is how often Michael Burry skepticism on Bitcoin comes during these volatility spikes, especially when crypto is down without any direct negative catalyst. As the crypto market absorbs the latest wave of liquidations, the vibe has shifted from surprise to concern.

What deepens the discussion is how often Michael Burry skepticism on Bitcoin comes during these volatility spikes, especially when crypto is down without any direct negative catalyst. As the crypto market absorbs the latest wave of liquidations, the vibe has shifted from surprise to concern.

Sponsored by

Blue Mong

3 months ago